Despite the current surge in the crude oil market, one international organization hasn’t jumped on the OPEC congratulatory bandwagon for its efforts to curb production. Here’s why… In the crucial time leading up to the production cut, OPEC’s output rose to a record 34.2 million barrels a day in November, according to the International Energy …

Category: Oil & Gas

Will Rex Tillerson Become the Next U.S. Secretary of State?

President-elect Donald Trump will nominate Exxon Mobil Corp. CEO Rex Tillerson as his secretary of state, according to a late report on Monday by The New York Times. An ardent conservative, Tillerson, 64, began his lengthy career in the oil industry as an Exxon production engineer in 1975, working his way up the corporate ladder …

T. Boone Pickens Statement on Rex Tillerson as U.S. Secretary of State

Official Statement from T. Boone Pickens on Rex Tillerson as U.S. Secretary of State President-elect Donald Trump’s anticipated selection of Rex Tillerson as America’s next Secretary of State is perfect. It would be tough to find someone more uniquely qualified to serve in that role. I’ve known Rex for decades. He is a thoughtful, strategic and …

WTI and Brent Crude Surge on Monday as Non-OPEC Members Agree to Production Cut

On Monday, crude oil futures logged their highest settlements since July 2015 after more oil producing nations agreed to curb production in an effort to rebalance supplies, according to Bloomberg MarketWatch. “The latest development is buoying optimism in the market,” said Vivek Dhar, a commodities strategist at Commonwealth Bank of Australia. “It shows that the …

Perry Meeting With Trump to Discuss Top Energy Secretary Post

Following a sidelines discussion with President-elect Donald Trump at the Army-Navy football game in Baltimore on Saturday, former Texas Governor Rick Perry was expected for a formal meeting in New York on Monday to discuss the possibility of heading up the U.S. Energy Department, according to numerous media sources. The meeting was quickly confirmed on …

Chesapeake Keeps Top Spot for Ohio’s Utica Shale

Three Oklahoma City-based energy companies are busy at work in Ohio these days. Oklahoma City-based Chesapeake Energy Corporation remains the top driller in Ohio’s Utica Shale according to a recent report by Kallanish Energy. Chesapeake received 825 permits since late 2010 from the Ohio Department of Natural Resources and its Division of Oil and Gas …

Natural Gas, WTI and Brent Crude Settle Higher on Friday

Crude oil and natural gas futures finished higher on Friday as traders monitored the OPEC production cut and forecasts for below-average temperatures bolstered the markets, according to Bloomberg MarketWatch. On the New York Mercantile Exchange, January West Texas Intermediate crude tacked on 66 cents, or 1.3%, to settle at $51.50 a barrel, marking a 2.2% gain …

Rig Numbers Soar Nationally but Slip in Oklahoma

National rig counts soared in the past week, climbing by 27 while the number of active oil and gas rigs in Oklahoma slipped by one, according to the last information from Houston-based Baker Hughes Company. The national count swelled to 624 including 21 more oil rigs to reach a total of 498. The number of …

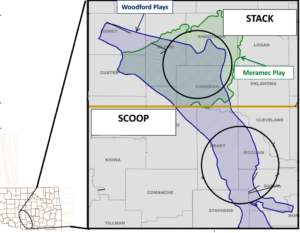

No Letup in Drilling Requests for Oklahoma’s STACK

Interest has yet to wane in Oklahoma’s STACK as the number of requests for permits to drill in the three-county area totaled 30 over the past week. A review of the permits as published by OK Energy Today shows the heaviest interest is in Kingfisher county where 14 permits were requested of the Oklahoma Corporation Commission in the …

WTI, Brent Crude Rebound With Settlements Above $50 on Thursday

Crude oil futures posted modest gains and moved settlements above the crucial $50 a barrel benchmark on Thursday, according to Bloomberg MarketWatch. On the New York Mercantile Exchange, January West Texas Intermediate crude gained $1.07, or 2.2%, to settle at $50.84 a barrel. On the London ICE Futures Exchange, February Brent crude, the global benchmark, tacked on …