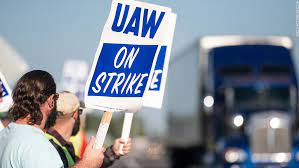

Could Elon Musk be the big winner from the United Auto Workers strike? A recent article by Politico provides a glimpse into the current situation.

The UAW’s work stoppage offers yet another massive headache for the Big Three automakers just as they’re gearing up to challenge Tesla in the growing market for electric vehicles. A generous settlement with the UAW could compound Detroit’s problems by widening the gap in labor costs between the U.S. auto giants and Tesla’s non-union factories. Either way, Tesla’s continued dominance on electric cars would undermine the Biden Administration’s hopes of basing the next generation of cars and trucks on unionized labor.

“Tesla’s competitive advantage over the Detroit Three is going to widen,” said Garrett Nelson, vice president of equity research at CFRA Research, an investment advisory firm. Ford, General Motors and Stellantis already pay their workers more than Tesla, he said, and that gap in labor costs is sure to grow even under the concessions the automakers have already offered.

For much of Biden’s presidency, the pro-labor White House was reluctant to even acknowledge that Musk’s vocally anti-union company is leading the nation’s move to electric vehicles. Tesla accounted for 60 percent of new electric vehicle sales in the U.S. in the second quarter of this year, according to Cox Automotive.

In 2021, the Biden Administration invited automaker executives to the White House lawn for a major EV summit, while snubbing Tesla and Musk.

In January 2022, Biden met at the White House with GM CEO Mary Barra and Ford CEO Jim Farley — but did not include a Tesla executive — to discuss the administration’s hopes for a big climate bill, prompting Musk to label the president a “damp (sock) puppet in human form.” Later that year, CNBC reported that the White House had privately indicated it wouldn’t invite Musk to future meetings with corporate leaders.

In response, Musk alleged at the time that Biden “has pointedly ignored Tesla at every turn and falsely stated to the public that GM leads the electric car industry.”

The ice seemed to thaw earlier this year as Biden recognized Tesla’s stranglehold on the EV market.

In January, two of the president’s top advisers, John Podesta and Mitch Landrieu, hosted Musk at the White House to discuss implementation of the administration’s tens of billions of dollars in electric vehicle incentives. Weeks later, the White House announced it had brokered a deal for Tesla to open some of its charging stations to the general public in exchange for access to federal dollars.

Most recently, the White House threw its support behind an effort to establish Tesla’s charging technology as an industry standard. It came after Tesla’s EV rivals — led by Ford and GM — decided to adopt Tesla’s North American Charging Standard, just months after the Biden Administration had mandated a rival charging standard for its federally funded chargers.

Various versions of three Tesla’s Model 3, Model Y and Model X vehicles also qualify for the full $7,500 consumer tax credit that the Treasury Department is offering under last year’s Inflation Reduction Act, at least for customers who earn less than the law’s income caps.

A lengthy strike could make it hard for Ford, GM and Stellantis to do two things they need to do to lure new customers — roll out new electric vehicle models and lower their prices.

Ford said in a statement last Thursday evening that the union’s demands would more than double the company’s UAW-related labor costs, “which are already significantly higher than the labor costs of Tesla, Toyota and other foreign-owned automakers in the United States that utilize non-union-represented labor.”

It is projected that with a six-week strike — the length of the last strike against GM in 2019 — the Big Three automakers would lose 200,000 sales to their competitors and be forced to raise prices by 2 to 5 percent, at least in the short term. Even if electric models are likely to be somewhat insulated from those effects because of abundant inventory, the strike could also slow the rollout of new models.

GM started taking orders for its Chevrolet Blazer EV in early September, and its Equinox EV and Silverado EV are set to launch later this fall. Ford plans to roll out its electric Explorer next summer.