What’s happening: Hydrogen is having a moment.

- Long hailed as an abundant and pollution-free energy source, hydrogen has failed to take off for a host of practical reasons: It’s costly and difficult to produce clean hydrogen, for instance, and there’s no nationwide distribution network.

- The Biden administration hopes to change that with new incentives for U.S. hydrogen production, which could help bolster sales of hydrogen-powered trucks now being introduced by a handful of manufacturers, including Toyota, Hyundai, Nikola and Cummins.

The intrigue: While it’s clear that trucking needs to clean up its act, there’s debate over whether that’s best achieved with hydrogen or battery-electric trucks.

- Conventional wisdom is that electric semi-trucks don’t make sense — their batteries would have to be so large and heavy that it would limit their range and/or cargo capacity.

- Hydrogen trucks don’t have that weight problem and can refuel quickly, meaning less downtime. Their total cost of ownership is also lower than an electric semi, industry officials say.

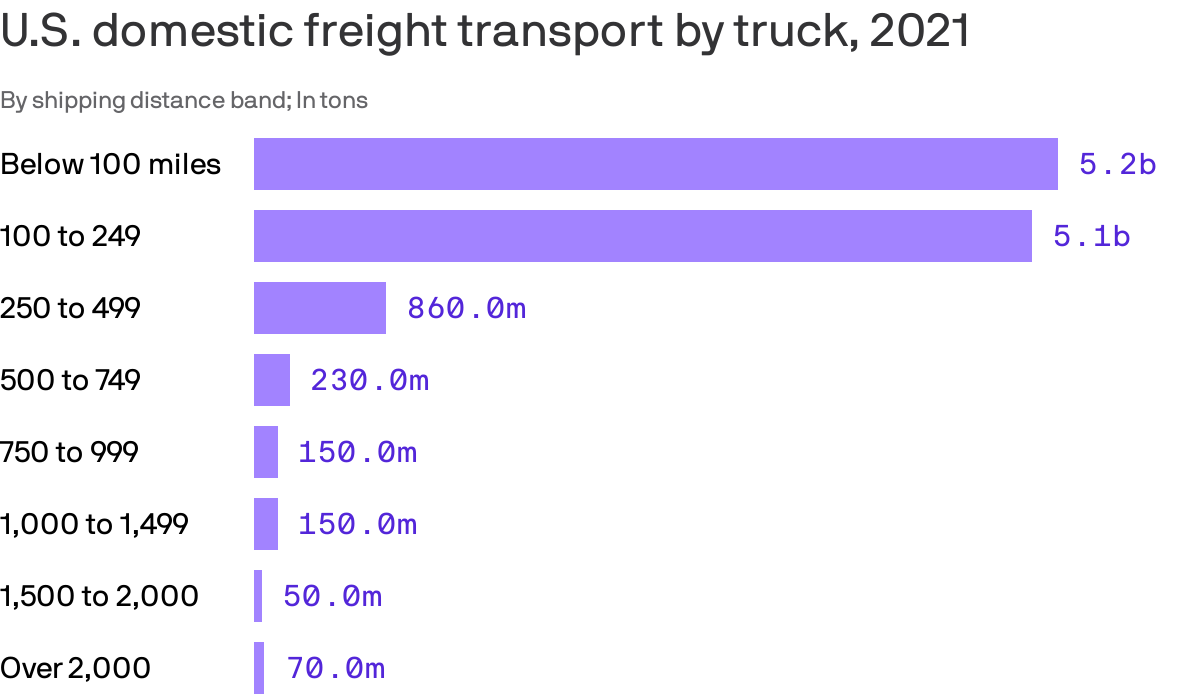

- Still, new U.S. Department of Energy data shows that the vast majority of freight tonnage is shipped distances of less than 250 miles — easily within the range of an electric semi.

Yes, but: Hydrogen trucks may still have a role to play, especially for long-haul routes and round-the-clock freight logistics operations — as long as the refueling challenges can be solved.

Driving the news: Nikola Motors, trying to put a slew of scandals and product miscues behind it, recently started producing its first hydrogen fuel cell semi-trucks in Coolidge, Arizona.

- Demand has been strong, the company said, with more than 200 orders to date. Deliveries are expected to begin this fall.

- The trucks boast a range of up to 500 miles and an estimated fueling time of approximately 20 minutes — similar to a diesel fill-up.

- A new $40,000 clean commercial vehicle federal tax credit, along with purchase incentives of $175,000 to $250,000 in states like New Jersey and California, are helping to goose sales, the company said.

- Another federal tax credit for clean hydrogen production will likely stimulate demand as well, although details are still being hammered out.

Other hydrogen trucks are hitting the market, too.

- Hyundai in May unveiled its new XCIENT fuel cell semi-truck for the North American market.

- Toyota, which piloted its Class 8 fuel cell trucks at the Port of Los Angeles, is partnering with Paccar, the parent of Kenworth and Peterbilt, to bring them to market in 2024.

- Hydrogen combustion engines from companies like Cummins and others are also gaining traction.

- They’re different from fuel cells, which create energy through a chemical reaction when hydrogen is mixed with air.

What to watch: There’s still a lack of hydrogen infrastructure.

- The U.S. has just 57 hydrogen stations (all in California), compared to nearly 8,000 DC fast-chargers for electric vehicles.

- Most truck fleets will have their own refueling equipment, in any case.

- Nikola’s infrastructure division, Hyla, is deploying smaller, mobile refueling systems so customers can easily refuel their trucks until full hydrogen stations are more readily available.

What they’re saying: Hydrogen has reached a “turning point,” says Jason Roycht, Nikola’s global head of fuel cell electric vehicle market development.

- “Five years ago, we had to explain the fuel cell solution. Now that’s not true anymore.”

The bottom line: The transportation industry will likely require both battery electric and hydrogen-powered vehicles to reach its net-zero carbon emissions goals by 2050.

Joann’s thought bubble: I recently got to drive Nikola’s battery-electric Tre semi-truck on a private track near Detroit. I was shocked at how effortless it was to drive — and how quiet it was.

- Electric trucks, including fuel cells, are going to revolutionize transportation.