Oil prices worldwide remain high over the Russian invasion of Ukraine but that apparently hasn’t translated into a rush for more oil and gas exploration in the U.S. according to the latest rig report from Enverus Rig Analytics.

The U.S. rig count fell by 13 in the last week to 754 as of March 23, according to Enverus Rig Analytics. Activity levels are up 2% in the last month and 58% in the last year. The count was as high as 775 in the last week compared to a peak of 769 the prior week, representing a six-well peak-to-peak increase. The March 23 reading is likely an indication of rig downtime rather than rigs being released.

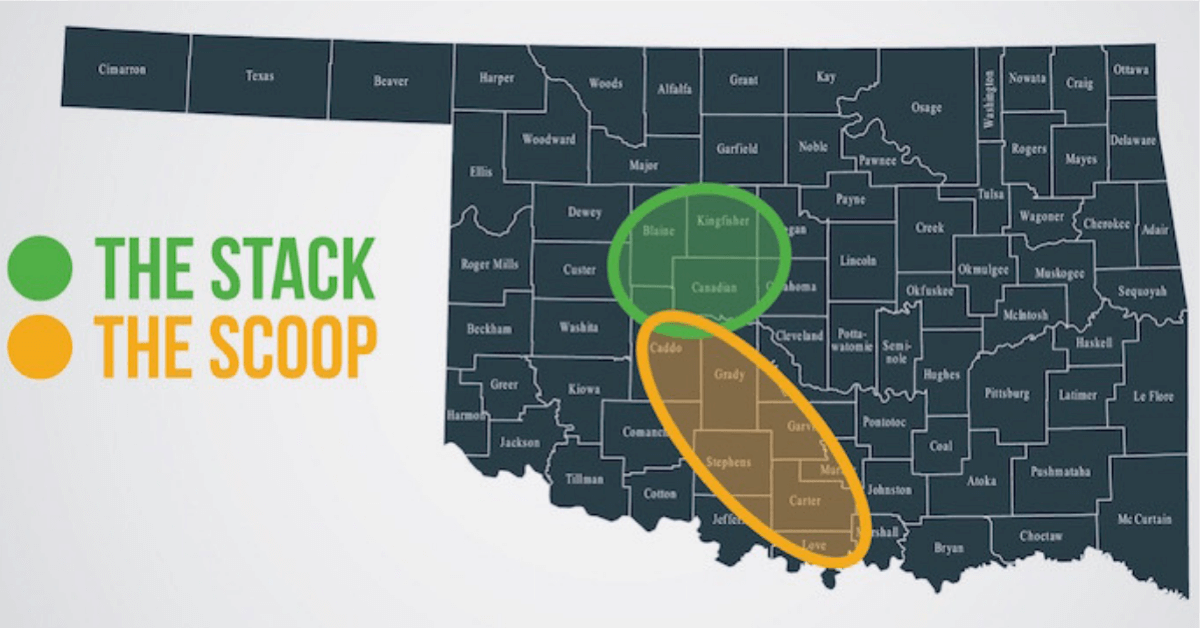

As of March 23, the Anadarko Basin has six fewer rigs running than a week ago, at 58. However, the peak-to-peak weekly change was a two-rig increase.

In the Permian, nine fewer rigs were active March 23 at 297, while the region had a smaller peak-to-peak decline of two rigs. The Appalachian daily count was down by three and by two on a peak-to-peak basis.

For plays with 10 or more rigs, seven stand out for their gains in the last year. Oklahoma’s SCOOP activity is up 214%, or 15 rigs, to 22. Camino Natural Resources (plus three to three), Citizen Energy (plus three to three), Continental Resources (plus two to five) and Gulfport Energy (plus two to two) account for 10 of the added wells.

Powder River Basin rig levels have charted a 200%, or eight-rig, YOY increase to 12. Anschutz Exploration (plus two to three) and Continental (plus two to two) fueled 50% of the increase.

The Bakken rig count is up 143% YOY, or 20 rigs. Two-rig increases were tallied by ConocoPhillips (at two total), Continental (six), Enerplus (two), Ovintiv (two) and Whiting Petroleum (three).

In the Eagle Ford, drilling activity has increased 88%, or 29 rigs, in the last year to 62. More than 50% of that increase is attributable to BP (plus three to four), Chesapeake Energy (plus three to three), Recoil Resources (plus two to two), Repsol (plus two to two), SilverBow Resources (plus two to two), Validus Energy (plus two to two) and Verdun Oil & Gas (plus two to two).

Rounding out the plays with increases of 80% or more are the Uinta Basin (plus five to 11), Texas Haynesville (plus 12 to 27) and STACK (plus eight to 18).