Nearly four months after Oklahoma Attorney General Gentner Drummond issued a “put up or shut up” demand of Corporation Commissioner Bob Anthony over his fraud claims regarding the issuance of bonds to cover the 2021 winter storm prices, Anthony stepped forward with another piece of evidence to back up his charges.

The Commissioner revealed over the weekend that one of the Wall Street banks involved in the bonds sold for Public Service Company of Oklahoma reimbursed the state $250,000 because it was apparently overpaid. It was also reportedly in response to Anthony’s strong criticism of the overpayments to banks who handled bonds for the utilities in question.

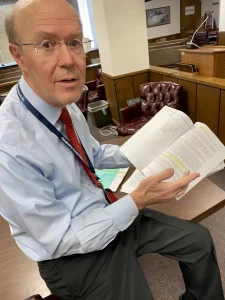

Anthony said a spreadsheet of PSO’s bond issuance costs submitted to the Corporation Commission at the end of December and recently posted to the OCC website showed the $250,000 line-item credit labeled “Redeposit from RBC.” The bank was originally paid $2,894,367.43 to underwrite PSO’s $700 million ratepayer-backed bond issuance in September 2022. It was nearly a year later when the overpayment totaling $250,000 was returned.

It was yet another piece of evidence supporting his claims over the past few years that there was fraud in the issuance of the bonds to cover storm costs—additional costs that he contends added billions more than should have been justified. Anthony’s claims were made in numerous filings with the Commission and it was October 2023, when the Attorney General demanded he surrender his evidence of emails to him. Anthony responded two days after he received the notice from Gentner.

“This credit is a drop in the bucket compared to the more-than-$2 billion of unnecessary securitization expenses that should not be paid by ratepayers,” said Anthony in a statement, “but it is a welcome start.”

The refund or “redeposit” was made September 16, 2023 ten days after Commissioner Anthony filed a Deliberations Statement in PSO’s rate case. He detailed millions in cost discrepancies related to the utility’s bond issuance cost and wanted them to be resolved before the OCC decided the case.

“The underwriters for PSO’s bond issuance were paid some $250,000 more than they bid to do the work,” wrote Anthony in the Sept. 6, 2023 filing he made, “and $900,000 more than the lowest bid received from a qualified writer.”

Anthony alleged that “if not corrected by this agency (the OCC) when financed at 4.545% over 20 years, I calculate this single overpayment alone will cost PSO’s ratepayers some $2.2 million.”

In his weekend statement, Commissioner Anthony called for the State Auditor to “examine these expenses in detail and tell everyone the exact amounts of the refunds owed.”

Audits of the bond payments have been a sore topic with Anthony who publicly last year chastized the Commission staff for doing only a one-page audit of prudence review cases for OG&E, ONG and PSO. He called it “ludicrous, “pitiful,” and “farcically inadequate” of the one-page audit of ONG’s bonds sent to lawmakers in September of last year.

He was stunned that despite billions in bonds and bond costs, the corporation commission’s audit consisted of one page. It did not consist of any lengthy report questioning or verifying expenditures.

“Who got paid how much for what?” was one of his questions regarding the $2.7 billion in 2021 Winter Storm bond deals for OG&E, ONG and PSO. Yet Commissioners Todd Hiett and then Commissioner Dana Murphy, followed by her successor, Commissioner Kim David, did not support his call for greater scrutiny of the expenses.

“At the very least, don’t ratepayers have a right to know how much all this is costing them and who is responsible? Or are we going to wait thirty years and tell their grandchildren?” he asked in one filing.

He made a call in September of last year for the Governor to enlist the State Auditor and Inspector to audit the bonds, including a $1 billion cost overrun and millions in discrepancies. Neither the governor, the house speaker, nor the senate pro-tempore responded.

Commissioner Anthony was also critical of the overcharges he contended were made in the ONG and OG&E bond cases as well.

“By my math, these bond issuance costs—themselves securitized and passed through to the ratepayers as part of the securitization expenses—totaled some $41 million, and to date I have been offered no evidence they were ever audited by anyone,” he stated at the time of his allegations last fall.

The commissioner charged that some $600,000 of OG&E and PSO’s “Utility Issuance Costs” that went beyond their expenses caps were categorized as “Non-Utility Issuance Costs” and passed along to—you guessed it—ratepayers. Consumers.

In the end, Anthony’s calls fell on deaf ears. It was April 2023, when Commissioners Todd Hiett and Kim David voted 2-1 to declare more than $6 billion of OG&E,, ONG and PSO’s 2021 fuel procurement processes and costs, including the unaudited Winter Storm bond issuance costs—“fair, just, reasonable and prudent” despite the billion-dollar cost overrun and the unresolved discrepancies.”

OK Energy Today sent email requests to Commissioners Hiett and David for responses over the weekend, but they had not responded as of Saturday.

Some of our questions to the two commissioners dealt with when they learned of the redeposit, why it is just now coming to light, and whether the redeposit makes them believe there should be a full investigation by the State Auditor.

Other documents:

- 11/1/2023 – Anthony response to AG’s “put up or shut up letter”

https://public.occ.ok.gov/WebLink/DocView.aspx?id=14150530

- 9/22/2022 – Anthony’s 74-page “Report Card on Securitization”

https://public.occ.ok.gov/WebLink/DocView.aspx?id=12294753