Reduced oil and gas revenue is having a growing impact on Oklahoma’s tax revenue, falling more than 25% over the past year.

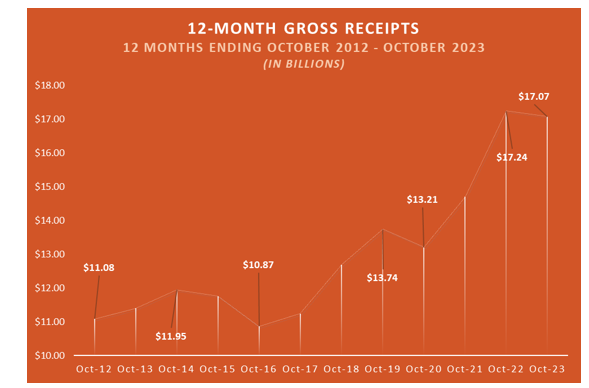

State Treasurer Todd Russ reported the state’s gross receipts for the last 12 months of $17.07 billion are more than $167 million or 1% below revenues from a year ago. He blamed reduced oil and gas revenue and said October marked the first time since March 2021 that receipts to the Treasury fell below the prior year’s 12-month revenue as expected.

Gross production revenue from oil and gas totaled $1.42 billion for the year, a drop of $484.1 million or 25.4%.

Revenue from the state’s Gross Production Tax dropped more than $484 million over the last 12 months, a decrease of more than 25 percent for the year.

Revenues from all sources in October total $1.4 billion. As anticipated based on recent monthly trends, the October total receipts are down by $73.8 million, or 5 percent.

In addition, the previous month comparison shows a decline from September to October of $72 million, or 4.9 percent

The Oklahoma Business Conditions Index in October still remained above growth neutral for the second consecutive month. The October index was set at 53.0, compared to 53.7 in September. Numbers above 50 indicate economic expansion is expected during the next three to six months.

According to the U.S. Bureau of Labor Statistics, the September unemployment rate in Oklahoma was 3.0 percent. Meanwhile, the U.S. unemployment rate was 3.8 percent in September, unchanged from the previous month.

Inflation as measured by the Consumer Price Index showed an annualized rate of 3.7 percent in September. The energy component of the index reflected a decline over the year, dropping 0.5 percent, and the food index ended at the same level as the overall inflation rate.

12-Month Gross Receipts

Combined gross receipts for the past 12 months compared to the prior year show:

- Gross revenue totaled $17.07 billion, $167.68 million, or 1 percent, below the previous 12 months.

- Gross income taxes generated $6 billion, an increase of $8.2 million, or 0.1 percent.

- Combined sales tax and use tax produced $7.1 billion, an increase of $331.7 million, or 4.9 percent.

- Oil and gas gross production taxes are $1.42 billion, a decrease of $484.1 million, or 25.4 percent.

- Motor vehicle taxes total $880.5 million, up by $6 million, or 0.7 percent.

- Other sources generated $1.64 billion, down by $29.4 million, or 1.8 percent.

- October Gross Receipts

Comparing gross receipts from October 2023 to October 2022 show:- Total monthly revenues are $1.4 billion, down by $73.8 million, or 5 percent.

- Income taxes – a combination of individual income taxes and corporate income taxes – generated $495.8 million, an increase of $1.3 million, or 0.3 percent.

- Combined sales tax and use tax – including remittances on behalf of cities and counties – total $590.3 million, an increase of $16.4 million, or 2.9 percent.

- Gross production taxes on oil and natural gas total $99.8 million, a decrease of $97.9 million, or 49.5 percent.

- Motor vehicle taxes produced $71 million, an increase of $4.2 million, or 6.3 percent.

- Other sources, composed of some 60 different sources, produced $146.8 million, an increase of $2.2 million, or 1.5 percent.