Not long after Oklahoma Treasurer Todd Russ notified 13 financial institutions they were no longer eligible for state contracts because of their ESG policies and anti-oil and gas industry financing, a study was released ranking 40 institutions for their lending practices.

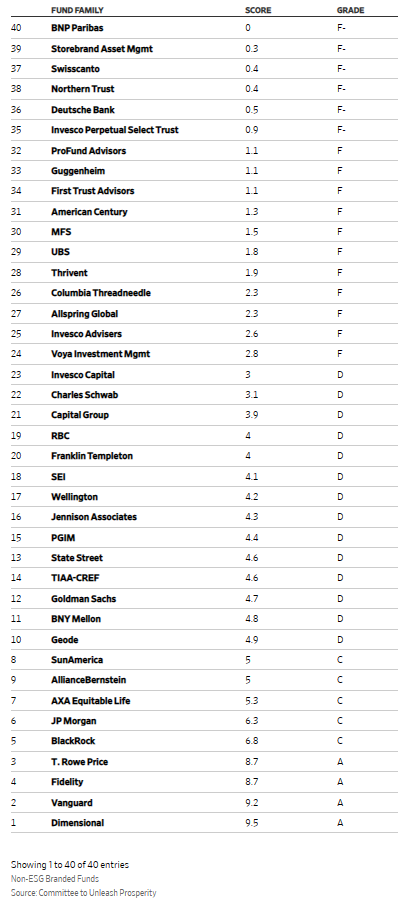

It was released by the Committee to Unleash Prosperity which studied the proxy voting behavior of the large investment firms and found some are allegedly violating their fiduciary duty to clients and “putting political ideology over achieving the best returns for investors.”

Entitled “Politics Over Pensions,” the study was featured in the Wall Street Journal.

The committee is critical of using ESG in financial lending.

“ESG investing is a disingenuous response by the left to its failure to enact its unpopular social policies (like race-based hiring) and its environmental agenda. Having failed through the open

political process to directly impose mandates on businesses, the tactic now is to try to foist its ideas on companies through an opaque process known as “proxy voting” that leverages the

money of others to interfere with corporate governance,” stated the study.

Read the full study here: https://www.pensionpolitics.com/report/

Three of the 13 financial institutions banned by Oklahoma’s Treasurer are included on the list of 40 created by the Committee to Unleash Prosperity.

They are J.P. Morgan, BlackRock and State Street Corp.

|