An examination of the price manipulation lawsuit filed by Kansas Attorney General Kris Kobach against Macquarie Energy over the February 2021 Winter Storm Uri shows Oklahoma had a role in what led to historic natural gas prices.

Kobach filed suit against the Houston company, alleging the company intentionally carried out certain gas trade steps that inflated prices to what he labeled “irrationally high price” for natural gas. His lawsuit was originally filed in Topeka, Kansas district court but earlier in May, the case was transferred to federal court.

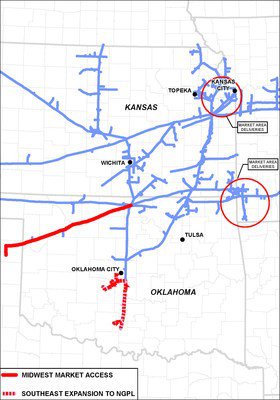

As to Oklahoma’s role in the development of the alleged price manipulation, it came about through what is known as the Southern Star Central Gas Pipeline, an interstate natural gas pipeline centered in Kansas but extending to Oklahoma, Missouri, Colorado, Wyoming, Texas and Nebraska. As Kobach’s lawsuit laid out, the eastern half of Kansas, Missouri and northern Oklahoma make up the pipeline’s “market zone” which is the primary population or market centers to which gas is delivered.

Parts of Oklahoma constitute the “production zone” which are areas that primarily collect natural gas from producers or producing locations and ship it to the market zone.

The Southern Star Gas pipeline was critical to Macquarie’s alleged efforts to “manipulate” the market, based on the claims made by the Kansas Attorney General.

” Aggravating an already stressed market, on the morning of February 16, 2021, Macquarie entered into an economically irrational natural gas trade in which it purchased natural gas for next-day delivery within Southern Star at the single highest price ever paid for Southern Star natural gas (the “Trade”). No one has ever paid more,” argued the Attorney General in his lawsuit.

He said no one has ever paid any fixed price for Southern Star gas even remotely close to the price that Macquarie agreed to pay.

“Counterintuitively, the Trade was not a fiasco for Macquarie, but instead a resounding financial success – because the actual effect of Macquarie’s Trade was to manipulate the Platts Southern Star Gas Daily price for February 17, 2021 upwards,” he stated, adding that Macquarie’s behavior and trade were “economically irrational and contrary to its self-interest as a natural gas marketer” unless it intended all along to manipulate the price.

How could one trade by Macquarie be labeled price manipulation? Because, as explained by the Attorney General’s lawsuit, the Southern Star Gas Daily price is highly susceptible to manipulation because there are far fewer qualifying transactions each day in Southern Star than in nearly all other Mid- Continent (and U.S.) trading locations – and, relatedly, substantially lower daily qualifying- transaction volumes.

Kobach contended the addition of even a single qualifying transaction had a greater ability to materially move the benchmark Gas Daily price than in nearly all other trading locations. The Trade thus elevated the February 17, 2021 Southern Star Gas Daily price by material amounts above what it would have been absent the Trade.

His suit alleged the February 17, 2021 Southern Star Gas Daily price, $622.785, was determined by calculating the volume-weighted average price of all qualifying trades – of which there were only two: the Trade and one other qualifying transaction.

“Had Macquarie not made the Trade, the February 17, 2021 Southern Star Gas Daily price would have been much lower, based on only one single qualifying transaction.”

Southern Star natural gas benchmark prices in early February were approximately $2.50/MMBtu, but spiked during February 13-16, 2021 to levels more than 100 times higher ($329.595/MMBtu) and, on February 17, 2021, to a level more than 200 times higher ($622.785/MMBtu).

So how did Macquarie have the ability, even with just one trade, to impact prices in such a way? Because of its size, argued the Attorney General. He says in North America overall, in the Mid-Continent region, on the Southern Star pipeline, the company’s size provided it with the ability to manipulate the benchmark Southern Star Gas Daily price.

Macquarie is not a small company. It is a wholly owned subsidiary of Macquarie Bank Limited, which in turn is a wholly-owned subsidiary of Macquarie Group Limited, an Australian multinational investment bank and financial services company employing more than 16,000 people across 32 markets around the globe. It had $428.5 billion in assets at the end of March 2021.

Macquarie is the North American energy marketing and trading arm of MGL’s Commodities and Global Markets division (“CGM”). 27. Although Macquarie was one small part of CGM, the amount Macquarie earned from two weeks of U.S. natural gas trading in mid-February 2021 was as much as CGM in its entirety normally earned in four years.

The price manipulation, as alleged by the Kansas Attorney General also had a direct impact on Kansas Gas Service, a wholly-owned division of Tulsa-based ONE Gas, Inc. It is also the largest natural gas distribution utility in Kansas and delivers natural gas to more than 640,000 Kansas customers. Thus, Macquarie’s actions, charged the AG, “artificially inflated the price that KGS paid for natural gas.”

As reported some weeks back, Macquarie also sold $154 million in gas to Oklahoma utilities during the same storm. Sales included $118 million to Oklahoma Natural Gas, $15.2 million to Oklahoma Gas & Electric Co. and $15.3 million to Public Service Co. of Oklahoma.

Kobach reacted with his own investigation of the matter after the American Public Gas Association begged the Federal Energy Regulatory Commission to “specially investigate.” It led to his lawsuit filed this year.

Oklahoma Corporation Commissioners have suggested to State Attorney General Gentner Drummond to do his own investigation. In March, a spokesman for Drummond said the attorney general was aware of the Kansas litigation and “has been reviewing whether there were similar circumstances in Oklahoma.”

When reached last week, Phil Bacharach, a spokesman for the attorney general replied, “All I can tell you is that the review is ongoing.”