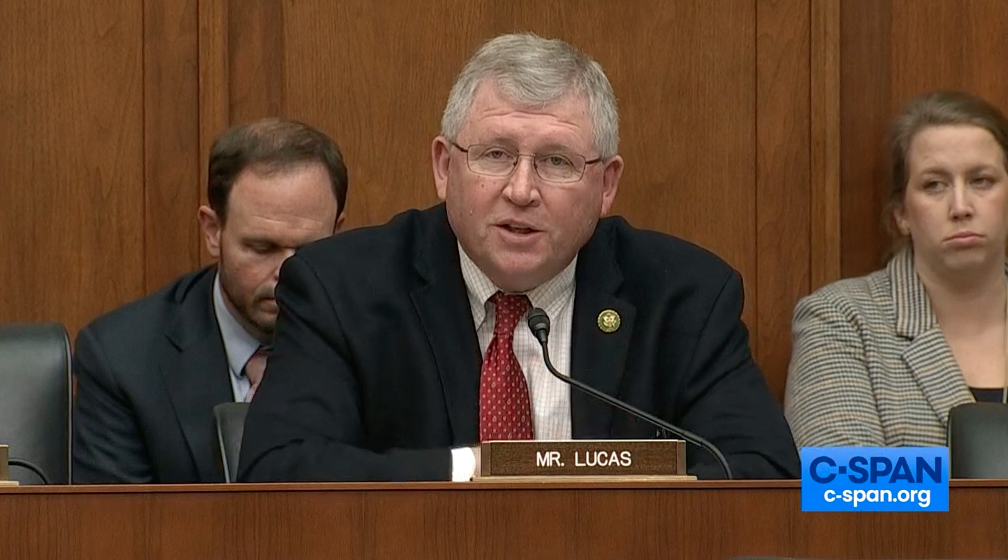

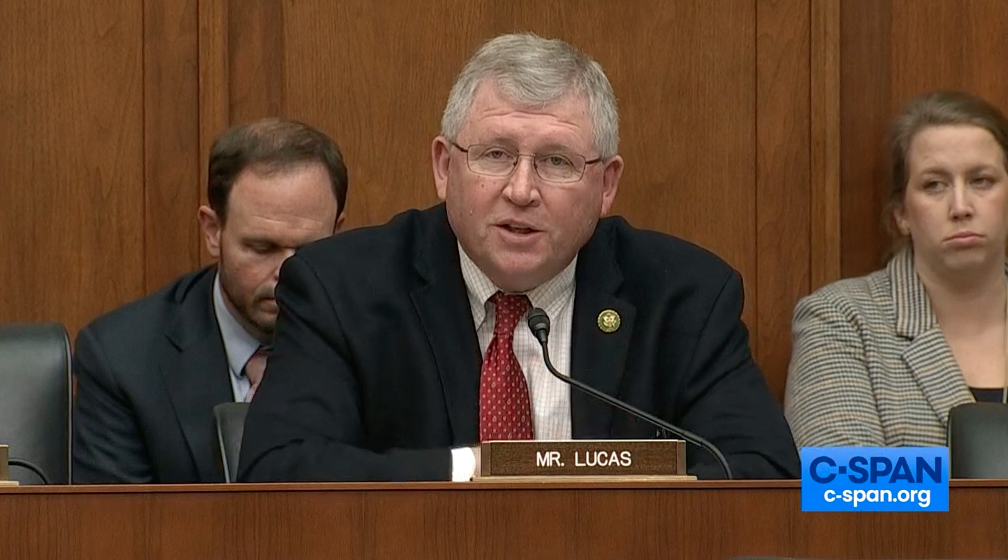

When a House Committee grilled federal regulators this week on their bailout of California’s Silicon Valley Bank, Oklahoma Congressman Frank Lucas was among those wanting some answers. He also reminded regulators of the infamous collapse of the Oklahoma City Penn Square Bank and the response of the FDIC in the early1980s.

He sits on the House Financial Services Committee which held a hearing on “The Federal Regulators’ Response to Recent Bank Failures.”

“Being one of the older members of this Committee, I’ve been around long enough to have observed firsthand several banking crises. In 1982, I was getting ready for my final semester at Oklahoma State when a little institution in Oklahoma City called Penn Square went down and took First Continental Illinois of Chicago down with it- a bank from the 1840s or 50s- and took First Seattle down with them too,” stated Rep. Lucas.

He reminded the regulators and others on the committee the combination of collapses of oil and gas and agriculture resulted in “the chain reaction in my great state was the slaughter of community banks.”

Lucas questioned the Chairman of the Federal Deposit Insurance Corporation (FDIC) and the Vice Chair for Supervision of the Federal Reserve on the collapse of Silicon Valley Bank (SVB) and Signature Bank. By guaranteeing uninsured deposits at both banks, the FDIC will place a special assessment on the banking sector to cover the losses. Congressman Lucas pressed FDIC Chairman Gruenberg to ensure that the burden does not fall on community banks.

Lucas also questioned Federal Reserve Vice Chair Barr about the specific timeline of determining the systemic risk designation for both banks. It is imperative that Congress have insight into the sequence of events and criteria used for this designation.

Click

here to watch Lucas’ Q&A.

Below are some of the comments by Lucas.

On special assessment fee

“I’d like to discuss the special assessment fee that will be used to cover the losses from the uninsured deposits. You’ve explained the proposed rulemaking for the special assessment will occur in May of this year. And while you’re thinking about that, be thinking about a discussion of the flexibility the FDIC has during the rulemaking to ensure that our small community banks don’t disproportionately carry the burden. Being one of the older members of this Committee, I’ve been around long enough to have observed firsthand several banking crises. In 1982, I was getting ready for my final semester at Oklahoma State when a little institution in Oklahoma City called Penn Square went down and took First Continental Illinois of Chicago down with it- a bank from the 1840s or 50s- and took First Seattle down with them too. Now, the FDIC and regulators responded in the appropriate fashion and addressed that. But it was a combination of collapse in the oil and gas industry and in production agriculture, and the chain reaction in my great state was the slaughter of community banks.

…

“And they’re looking at this situation and they’re saying to me, we’ve been the least problematic of any sector in the financial services industry for decades to the regulators and the FDIC, but yet in every crisis since then, we’ve been kind of the orphans. And this time they’re saying we were wiped out as an industry 40 years ago, but now we’re going to get a special assessment to pay to fund for the mistakes of the most sophisticated institutions, the biggest institutions. Can you tell me how it’s possible when this special assessment fee process is completed that my community bankers aren’t going to wind up disproportionately paying for the mistakes and the faulty roll of the biggest institutions in the country?”

Source: Lucas press release