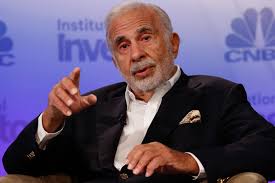

Billionaire investor Carl Icahn says the energy sector will bounce back one day but shareholders need to be very patient and he is not urging people to buy.

Icahn, with stakes in SandRidge Energy, CVR Energy, Cheniere Energy and Occidental Petroleum, said the key to making money is to buy when companies are out of favor.

“I’m not saying go out and buy energy stocks tomorrow,” he noted at the 13D Monitor Conference on activist investing.

Icahn’s investment style, he acknowledged, is a little different as an activist who proposes remedies to companies with management problems and often wins board seats.

“We’ve been really helpful at many companies,” often by freeing them from incompetent management, Icahn said. Forbes estimates his net worth at $16.7 billion.

Critics have called him a corporate raider for his hostile takeover in 1985 of Trans World Airlines whose assets he stripped, leading to its demise.

“I work all day, don’t ask me why,” said Icahn, aged 84, when most people are comfortably retired. “I have a lot of different deals going on. I like the action.”

As of nearly a year ago, he held 13% interest in Oklahoma City’s SandRidge Energy with his appointees on the company’s board of directors.

Source: Reuters