The state of North Dakota prepares for a slowdown in drilling activity by its largest producers—Oklahoma’s Continental Resources Inc. and Marathon Oil Company of Houston.

As Continental recently indicated, it plans a suspension of its quarterly dividends and will cut crude oil production in the Bakken and elsewhere. Marathon said it will take hydraulic fracturing “holidays.”

How the declines in activity will affect employment at the new big companies isn’t known. But in the past few weeks, Continental chairman and founder Harold Hamm vowed his firm would not cut its workforce, promising the company had the ability to survive.

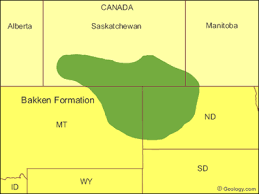

It was in the Bakken where Hamm and his company made their reputation, eventually becoming the largest oil producer for North Dakota. It would not be exaggeration to describe the Bakken as the “bread winner” for Hamm’s Continental Resources.

The new cuts were announced amid both an international price war between OPEC and Russia and the continuing COVID-19 pandemic. The price war appears to be ending, but demand destruction due to coronavirus continues. More than a quarter of the world’s oil demand has evaporated amid stay-home orders and other steps to curtail spread of the virus.

Continental’s dividend will be suspended until further notice. It will also reduce crude oil production by 30 percent, instead of just the 5 percent it had announced in mid-March.

In March, Continental had said it would cut capital expenditures by 55 percent, dropping expected capex to $1.2 billion. That program was expected to fund three rigs in the Bakken and four in Oklahoma, and would result in a 5 percent crude oil production drop.

“Continental will continue to take decisive action to maximize cash flow generation, accomplish cost savings initiatives, and prioritize the strength of our balance sheet,” Continental’s Chief Executive Officer Bill Berry said. “Global crude and product demand is estimated to have been impacted by 30 percent due to COVID-19. Accordingly, we are reducing our production for April and May 2020 in a similar range.”

Marathon, meanwhile, is revising its capital spending budget to $1.3 billion or less, a reduction of $1.1 billion from initial 2020 guidance. That is 50 percent below actual capital spending for 2019 according to the Williston Herald.

In mid-March, the company had announced a 30 percent or $500 million reduction in its planned spending, completely cutting its drilling and completion activity in Oklahoma.

Now it will also suspend drilling activity in the Northern Delaware. In the Bakken, it will continue to “optimize” development plans, and likewise the Eagle Ford. Then it will before shift to a lower and more continuous drilling and completion plan for the second half of 2020 in those resource plays.

“In light of extreme commodity price weakness and anticipated ongoing demand impacts, we have dramatically reduced activity in REx, Oklahoma and the Northern Delaware, and plan to take frac holidays in both the Bakken and Eagle Ford during second quarter. We’re maintaining our returns-first mindset with a focus on preserving value through the cycle,” Marathon Oil Chairman, President, and CEO Lee Tillman said. “We believe our high quality, multi-basin portfolio affords us ample flexibility to swiftly and appropriately respond to changing market conditions, and we currently expect to transition to a more continuous but lower level of activity in both the Bakken and Eagle Ford during the second half of the year. Against a highly volatile and uncertain environment, these decisive actions are designed first and foremost to protect our balance sheet and our hard earned financial strength. We remain investment grade at all primary rating agencies, with recent reviews by both Fitch and S&P, and maintain a strong liquidity position with no near-term debt maturities. Our financial strength, high quality portfolio, and ongoing focus on reducing our cost structure position us well to navigate this extraordinary time for our industry.”

Marathon has also restructured its hedges to better protect near-term crude oil downside and basis differentials.

Both companies plan to release additional details of their revised plans for 2020 in their next earnings calls.

Source: Williston Herald