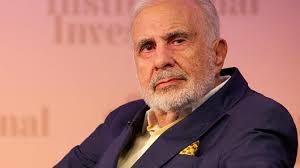

Corporate raider and activist investor Carl Icahn is at it again. In an open letter to Oklahoma City-based SandRidge Energy, Icahn is seeking the ability to appoint a member on the oil and gas company’s board of directors, according to a news report by The Oklahoman.

Icahn spent over $82 million in October and November to buy nearly five million shares of stock, resulting in his control of a 13.5 percent stake in SandRidge. The 2017 purchases now make Icahn the largest SandRidge shareholder.

In typical Icahn fashion, the investor demanded a leadership change, calling for two board members to resign while attacking CEO James Bennett’s leadership and salary. Icahn has frequently challenged SandRidge expenses and financial strategies.

In the November 30, 2017 letter, Icahn rips the actions of SandRidge directors by pointing out the company eliminated nearly $4 billion in debt and canceled all shareholder equity through Chapter 11 bankruptcy reorganization proceedings.

“Management fared considerably better,” said Icahn, in the open letter to SandRidge management. Icahn takes direct aim at SandRidge CEO James Bennett.

Bennett “was paid very large amounts for his part in the disaster, and his predecessor received even more compensation. Indeed, historically, SandRidge’s most senior management recovered princely sums in compensation while the stockholders ended up with nothing,” said Icahn, in the letter.

In another letter, Icahn sought data regarding “SandRidge senior management compensation, the $90 million severance payment awarded to ousted former CEO Tom Ward, the planned Bonanza Creek purchase and the shareholder rights plan, or poison pill, SandRidge directors adopted last month to limit the influence of Icahn and other large investors,” according to The Oklahoman.

In response to Icahn’s requests, SandRidge said Tuesday its board and management team “value constructive shareholder dialogue.” The company said its directors will meet with large shareholders next week. Icahn was invited to this meeting.