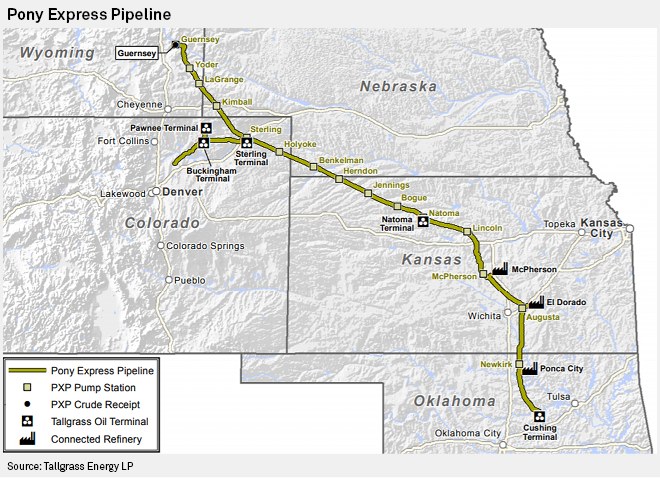

Tallgrass Energy Partners, LP, the Kansas City-based company with pipelines extending to Oklahoma’s Cushing Hub, announced this week an $800 million offering of notes.

Designed to raise money for the company, the offering was increased from the original $700 million to the new value of $800 million. It includes 7.375% senior unsecured notes due 2029 at an offering price equal to 100% of par.

The Notes Offering is expected to close January 23, 2024, subject to satisfaction of customary closing conditions. TEP intends to use the net proceeds of the Notes Offering to fund the purchase of its outstanding 7.50% Senior Notes Due 2025 (the “2025 Notes”) in the concurrent cash tender offer (the “Tender Offer”), to deposit funds with the trustee sufficient to satisfy and discharge the indenture and any 2025 Notes outstanding after completion of the Tender Offer until redeemed on October 1, 2024 with the funds deposited with the trustee and to repay a portion of the outstanding balance of its revolving credit facility, with any excess to be used for general partnership purposes.

The Tender Offer is being made pursuant to an Offer to Purchase dated January 16, 2024.