Williams announced that it has successfully closed two strategic transactions with a value of $1.27 billion that now position the company as the third largest gatherer in the DJ Basin.

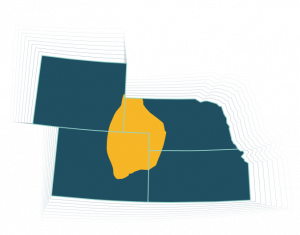

Formally called the Denver-Julesburg Basin, it is a large geological formation in northeastern Colorado and southeastern Wyoming. It extends into parts of Nebraska, South Dakota and Kansas. The DJ, as an oil producer, was discovered more than 70 years ago.

Williams’ acquisition of Cureton Front Range LLC included assets of gas gathering pipelines and two processing plants serving producers across 225,500 dedicated acres. And second, the purchase of KKR’s 50 percent ownership interest in Rocky Mountain Midstream Holdings LLC (RMM), resulting in 100 percent ownership of RMM for Williams.

“We remain committed to executing on acquisitions that progress our overall strategy to maintain top positions in the basins we serve,” said Alan Armstrong, president and CEO of Williams. “The combination of the Cureton and RMM assets will deliver tangible operational synergies that include increased volumes on our existing processing facilities, as well as increased revenues on our downstream NGL transportation, fractionation and storage assets.”

Williams first announced the Cureton and RMM transactions in its third quarter earnings materials earlier in November. The acquisitions have a combined value of $1.27 billion, representing a blended multiple of approximately 7x 2024 Adjusted EBITDA.

Proceeds of $355 million from the company’s recent sale of its Bayou Ethane Pipeline system along with $533 million in net proceeds now received from the Energy Transfer legal judgment of $627 million (which included legal fees owed to others) partially funded the transactions.

Source: Williams press release