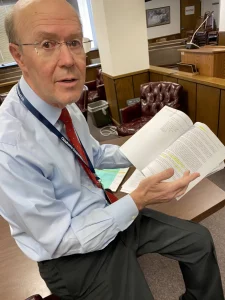

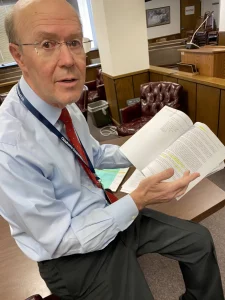

While Oklahoma Corporation Commissioner Bob Anthony supported a move by state regulators to put a 2.5% cap as part of the Public Service Company of Oklahoma rate case, he couldn’t get support for a detailed audit of what was approved for the utility.

He was still critical of the one-page audit provided by PSO at the time of the rate hike vote approved earlier on a 2-1 decision.

He immediately filed a six-page Dissenting Opinion assailing his fellow commissioners Todd Hiett and Kim David for what Anthony called their ‘dereliction of duty’ for failing to audit the utility’s 2021 Winter Storm bonds.

According to Anthony, both the Securitization Act passed by the legislature and the OCC’s subsequent Financing Orders allowing OG&E, ONG and PSO to use ratepayer-backed bonds to spread out their February 2021 Winter Storm costs

require audits of the bonds and their expenses as part of utility rate cases like the one decided Friday.

In particular, Anthony says that more than a year after he first asked the utility and his own agency for “specific information about ‘Who got paid how much for what?’ among the $10.5 million in Bond Issuance Costs PSO reported were incurred to issue its almost $700 million of 2021 Winter Storm bonds … answers to this multi-million-dollar question remain incomplete.”

He says the same is also true “for the bonds’ Ongoing Financing Costs, estimated by PSO in September 2022 to be some $700,000 annually for the next 20 years.” A recent email response Anthony cites from the Corporation Commission’s Public Utility Division indicates the agency doesn’t even know the actual ongoing cost data for the utility’s bonds, let alone “the identity of the entities that have received funds as a result of the Ongoing Financing Costs or the specific services rendered.”

Pointing out that the Ongoing Costs allow PSO itself to recover a “servicer fee” as well as reimbursement for its costs to collect the bond payments from customers on their monthly bills, Anthony openly speculated on the rationale for the approved order’s failure to even mention the bonds’ Ongoing Costs.

“When a company is paid more than its costs to provide a service, the excess is called PROFIT! Could it be that after two years of promising that the OCC would not allow the utilities to ‘profit’ on their Winter Storm fuel costs, the OCC is ignoring the very existence of these Ongoing Costs out of fear that acknowledging them would attest to the true profitability of securitization for these utilities?”

In September 2022, Anthony issued a 74-page “Report Card on Securitization” showing that the Winter Storm bonds wound up costing Oklahoma utility customers a billion dollars more than had been estimated, $200 million of which is attributable to PSO’s bond issuance.

Since then, Anthony has made repeated filings showing what he calls “millions in cost discrepancies,” including banks apparently paid hundreds of thousands more than they bid to underwrite the bonds, and utility expenses that were apparently recategorized as “non-utility” expenses in order to bypass a utility expense “cap” and pass the costs through to ratepayers anyway.

In spite of this, according to Anthony, “In the year since the 2021 Winter Storm bonds were issued, no audit of the actual costs – original or ongoing – has ever been conducted.”

Anthony concludes that PSO customers “should be outraged that 2.5 years after the February 2021 Winter Storm, the state agency responsible for overseeing the charges on their monthly utility bills still can’t tell them specifically ‘Who got paid how much for what?’ or how much it will all ultimately cost them.”

Anthony calculates the price PSO’s customers are paying for the utility’s Winter Storm bonds is nearing $1.08 billion.

Read Anthony’s full Dissenting Opinion here: