Ovintiv, the company with a history of large producing oil wells in Oklahoma’s STACK play announced the $4.2 billion acquisition of more holdings in the Midland Basin of Texas, while at the same time selling its Bakken assets in North Dakota in an $825 million agreement to help finance the Midland deal.

The Denver, Colorado based company said its Midland Basin acquisition of nearly 65,000 acres from Black Swan Oil & Gas, PetroLegacy Energy and Piedra Resources was a cash and stock transaction valued at approximately $4.275 billion.

Within hours, Ovintiv stock soared with a nearly 12% gain for the day on the New York Mercantile Exchange. The company stock recorded a $4.30 a share increase for a gain of 11.92% to close at $40.38.

To help finance the acquisition, Ovintiv sold all of its Bakken assets in the Williston Basin of North Dakota to Grayson Mill Bakken, LLC, a portfolio company of funds managed by EnCap.

Ovintiv’s landholdings in the play totaled 46 thousand net acres as of December 31, 2022. Estimated first quarter Bakken production is expected to average approximately 37 MBOE/d (60% oil and condensate).

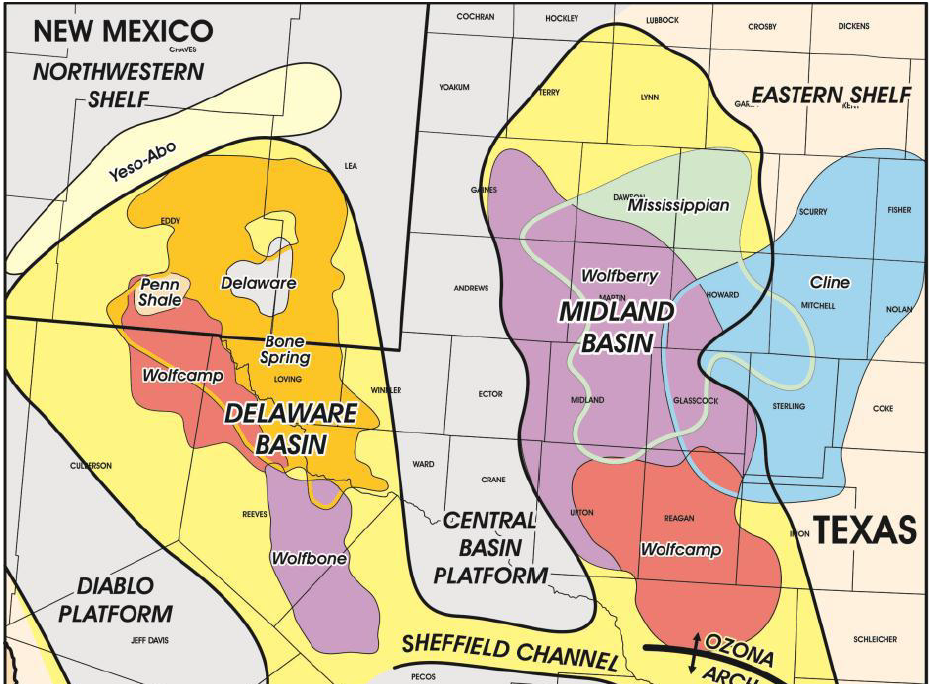

Upon closing, the Midland acquisition will add approximately 1,050 net 10,000 foot well locations to Ovintiv’s Permian inventory and approximately 65,000 net acres in the core of the Midland Basin, strategically located in close proximity to Ovintiv’s current Permian operations. The transaction has been unanimously approved by Ovintiv’s Board of Directors.

The 65,000 acres are described as largely undeveloped resources in Martin and Andrews Counties.

Under the terms of the agreement, the sellers will receive approximately 32.6 million shares of Ovintiv common stock and $3.125 billion of cash. The cash portion of the transaction is expected to be funded through a combination of cash on hand, cash proceeds received from the Company’s pending sale of its Bakken assets located in North Dakota to Grayson Mill Bakken, LLC, a portfolio company of funds managed by EnCap, totalling approximately $825 million, as well as borrowings under the Company’s credit facility and/or proceeds from new debt financing. Ovintiv has received fully committed bridge financing from Goldman Sachs Bank USA and Morgan Stanley.

“We are acquiring a unique undeveloped asset in the Northern Midland Basin,” said Ovintiv President and CEO, Brendan McCracken. “Located in some of the best rock in the Permian, these assets have demonstrated leading well performance and are a natural fit with our existing Martin County acreage.”

Ovintiv’s land position in the Permian is expected to increase to approximately 179 thousand net acres; 97% of the acquired acreage is held by production with an average operated working interest of 82%. Following the transactions, Ovintiv’s portfolio will be focused in four premier North American basins each with more than 125,000 net acres of land.

Ovintiv also announced today that it has entered into a definitive agreement to sell the entirety of its Bakken assets located in the Williston Basin of North Dakota to Grayson Mill Bakken, LLC, a portfolio company of funds managed by EnCap for total cash proceeds of approximately $825 million. Ovintiv’s landholdings in the play totalled 46 thousand net acres as of December 31, 2022. Estimated first quarter Bakken production is expected to average approximately 37 MBOE/d (60% oil and condensate).

McCracken added, “The sale of our Bakken asset is aligned with our track record of unlocking significant value from non-core assets while high grading our portfolio and extending inventory runway in our core areas. We are grateful for the hard work of our Bakken team and pleased to receive full value for the asset.”