Finances improved in the fourth quarter for Gulfport Energy Corporation as the Oklahoma City-based firm with major operations in the Utica play reported $188 million in net cash in stead of an $18.5million net loss it had in the third quarter of 2022.

Its efforts were strong enough that Gulfport expanded its common stock repurchase program from $300 million to $400 million. During the quarter, the company generated the $188 million in net cash from operating activities and had $33.2 million in adjusted free cash flow.

Gulfport also repurchased 206,000 shares of common stock for $13.6 million.

In the third quarter, the company had the $18.5 million net loss and $172.7 million of adjusted EBITDA. It had $167.9 million of net cash.

Drilling efforts saw net production of 1,051.6 MMcfe a day while for the full year, it was 983.4 MMcfe a day. Full year net income was $494.7 million and $768.4 million in adjusted EBITDA.

The year also generated $739.1 million in net cash and $240.6 million in adjusted free cash flow. It helped Gulfport increase its borrowing base from $850 million to $1 billion through its revolving credit facility. At the same time, the firm reduced total debt by $19 million.

Gulfport indicated it anticipates up to a 6% increase in natural gas production this year over 2022 production. As a result, the firm plans to invest total capital expenditures of $450 million including up to $75 million on leasehold and land investment.

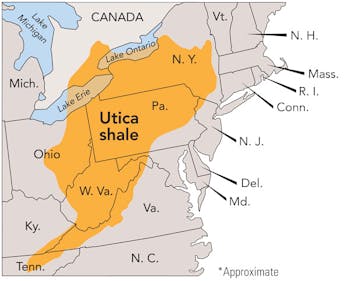

What’s that mean in terms of wells? Gulfport is forecasting it will turn to sales 22 to 24 gross wells including 2 wells targeting the Marcellus, 2 wells in the SCOOP and the rest in the Utica.

“2022 was a productive year for Gulfport, maintaining inventories of high quality acreage, delivering quality results from the development program, generating significant free cash flow and returning meaningful capital to shareholders through common share repurchases,” commented John Reinhart, CEO of Gulfport.

Gulfport finished the year with 19 wells spudded in the Utica, 6 in the SCOOP while the number of completed wells was 15 in the Utica and 13 in the SCOOP.

Production for 2022 averaged 692.9 MMcfe a day in the Utica and 290.5 MMcfe a day in the SCOOP.

Click here for entire report