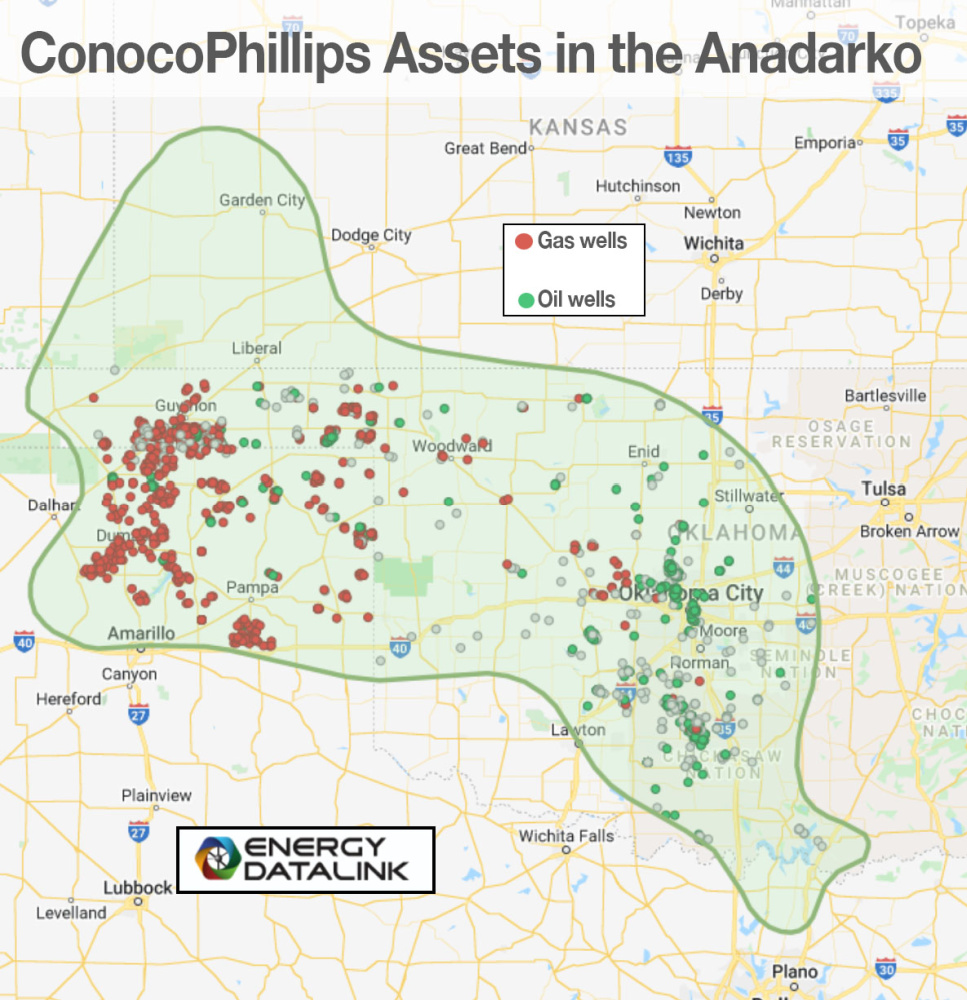

Reports indicate ConocoPhillips Co. is possibly going to sell some 280,000 net acres in assets in Oklahoma and Texas that make up its Anadarko Basin holdings.

The primary holdings are in the STACK and SCOOP plays according to CEO Ryan Lance.

“Cash is cash. We just want to take advantage of the strong markets we’re seeing today, and we recognize that we’ve made two pretty transformational transactions over the course of the last year, and it’s raised the bar in our whole company on cost of supply.”

HART Energy reported that marketing materials from Wells Fargo dated Spring 2022 show the assets’ EBITDA, annualized by first-quarter 2021 results is about $97.5 million.

The acreage in the Anadarko Basin included 261,200 acres, 100% HBP that produces 77% gas and 23% liquids in the first-quarter 2021. The assets are in the Cleveland, Granite Wash and Tonkawa areas of the Basin.

ConocoPhillips had indicated earlier that it planned up to $5 billion in asset disposition by 2023. The company is still working on reduction of debt and hopes to trim it to about $15 billion by 2026. In February, ConocoPhillips had closed the $1.65 billion sale of its Indonesia assets and nearly $700 million in assets in the Lower 48 over the past year.

Lance told a February earnings call the company was still reviewing what to sell based on historical cash flow. Just 14 months ago, the company closed the acquisition of Permian independent Concho Resources Inc. in an all-stock transaction valued at $13.3 billion.

ConocoPhillips will reveal more details in April and May when management presentations are made.