Helmerich & Payne, Inc. in Tulsa reported a net loss of $51 million, or $(0.48) per diluted share, from operating revenues of $410 million for the quarter ended December 31, 2021.

It showed that while the company recorded a loss, it was still an improvement over a year earlier.

The company stated that the loss compared to a net loss of $79 million, or $(0.74) per diluted share, on revenues of $344 million for the quarter ended September 30, 2021. The net losses per diluted share for first quarter of fiscal year 2022 and the fourth quarter of fiscal year 2021 include $(0.03) and $(0.12), respectively, of after-tax gains and losses comprised of select items.

Net cash used by operating activities was $4 million for the first quarter of fiscal year 2022 compared to net cash provided by operating activities of $47 million in the prior quarter.

The Tulsa firm’s North America Solutions operating gross margins increased $15 million to $84 million from the previous quarter as revenues increased $48 million to $341 million.

President and CEO John Lindsay commented, “I am encouraged by the progress the industry has made on its path to recovery from the market collapse in 2020.”

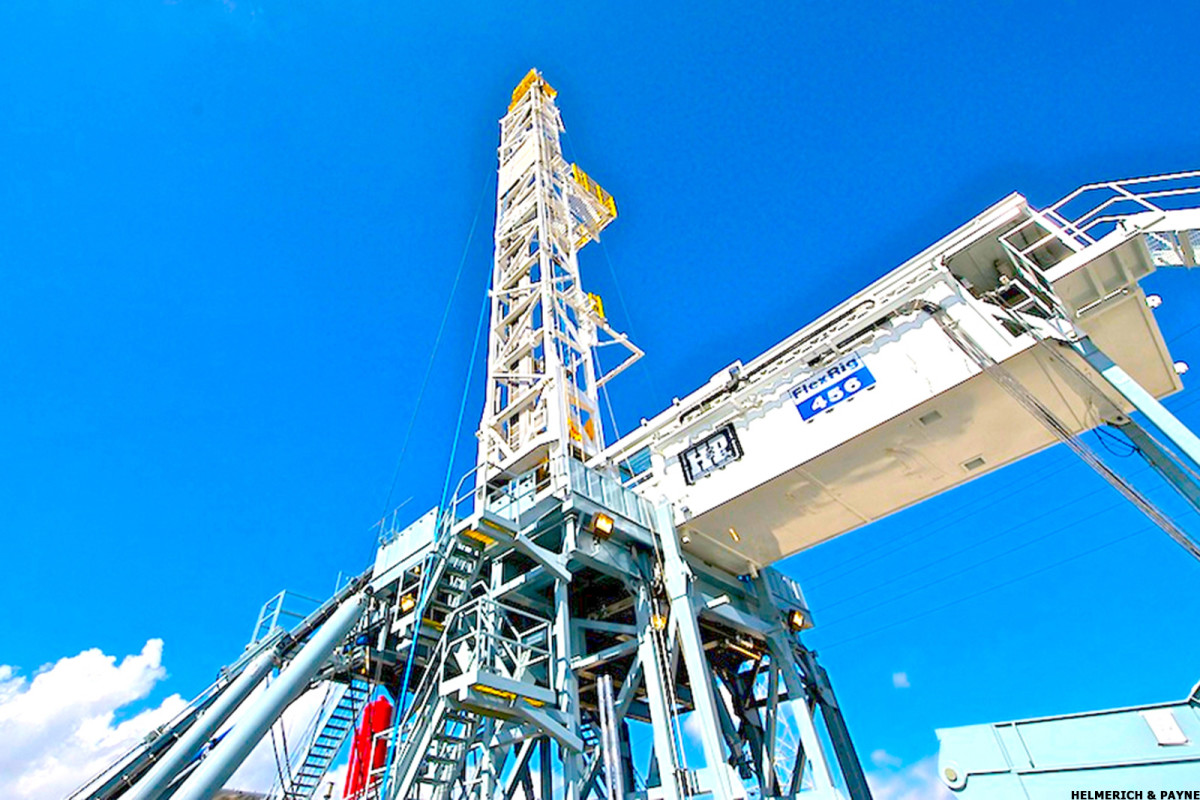

He said increasing demand for super-spec rigs has predictably led to a very tight market in 2022.

“As expected this demand increase resulted in a significant uptick in our rig count during the first fiscal quarter, which we anticipate will likely be followed by a more moderate, yet still healthy increase in the second fiscal quarter.”

But he also warned of higher prices that are necessary because of costs associated with reactivating idle super-spec rigs.

“Notwithstanding the activity improvements and higher commodity prices that have benefited the industry, from an oilfield service provider perspective, substantially higher pricing is still required in order to generate the returns necessary to attract and retain investors and for this business to be vibrant and sustainable.

The company’s North America Solutions segment exited the first quarter of fiscal year 2022 with 154 active rigs, up over 20% during the quarter.

Click here for Business Wire release