Chesapeake Energy Corp. announced Tuesday it had reached a $2.6 billion cash and stock deal to acquire Dallas-based Chief E&D Holdings and associated assets in the prolific Marcellus shale gas basin of Pennsylvania.

The Oklahoma City-based company also said it would be selling assets in Wyoming’s Powder River Basin to Continental Resources for $450 million.

The company signed definitive agreements to acquire Chief E&D Holdings, LP and associated non-operated interests held by affiliates of Tug Hill, Inc., for $2.0 billion in cash and approximately 9.44 million common shares. Chief and Tug Hill hold high quality producing assets and an inventory of premium drilling locations in the Marcellus Shale in Northeast Pennsylvania. The cash portion of the transaction will be financed with cash on hand and the use of the company’s revolving credit facility. The transaction, which is subject to customary closing conditions, including certain regulatory approvals, is expected to close by the end of the first quarter of 2022.

“We know the importance of scale and the Chief and Tug Hill assets fit like a glove with our existing position in the northeast Marcellus Shale,” said Nick Dell’Osso, Chesapeake’s President and Chief Executive Officer.

“The acquisition checks all the boxes: it lengthens our premium inventory, further focuses our capital allocation, provides operational efficiencies, is accretive to free cash flow per share, allows us to grow our base dividend, preserves our balance sheet strength and improves our GHG emissions metrics.”

Dello’Osso said upon closing, Chesapeake will benefit from a high-quality portfolio in three premier U.S. hydrocarbon basins—the Marcellus, Haynesville and Eagle Ford.

Under the terms of the Chief and Tug Hill agreements, which were unanimously approved by Chesapeake’s Board of Directors and also approved by Chief and Tug Hill, Chesapeake will acquire approximately 113,000 net Marcellus acres (>90% held by production). Assuming an April 1, 2022 closing date, the asset is currently projected to produce approximately 835 million cubic feet of net gas per day for nine months in 2022 and generate about $500 million in 2022 projected adjusted EBITDAX (including acquired hedges) at current commodity strip prices.

Upon closing of the transactions, Chesapeake plans to operate two rigs on the acquired properties during 2022, resulting in a total of 9 – 11 gas-focused rigs and 2 – 3 oil-focused rigs. The company will maintain a disciplined capital reinvestment strategy, anticipating a 2022 reinvestment rate of approximately 47%.

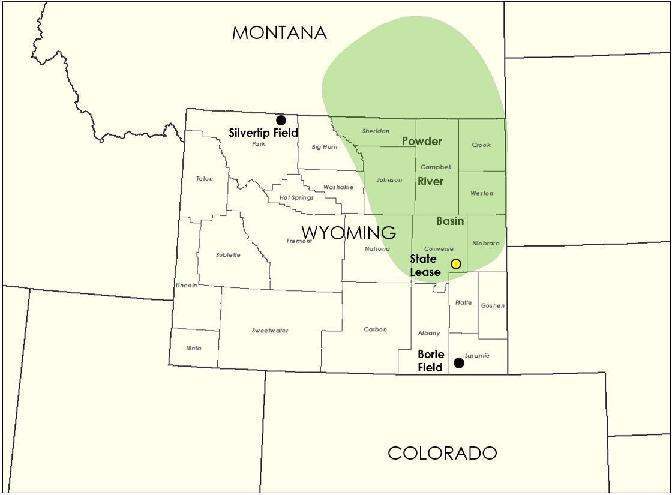

Chesapeake also signed an agreement to sell its Powder River Basin assets in Wyoming to Continental Resources, Inc. for approximately $450 million in cash. The transaction, which is subject to certain customary closing conditions, is expected to close in the first quarter of 2022. At closing, net proceeds from the sale will go toward the purchase price of the Chief acquisition.

The company’s Powder River Basin assets include approximately 172,000 net acres and 350 operated wells in southeastern Wyoming. Fourth quarter 2021 Powder River Basin volumes are expected to average approximately 19,000 barrels of oil equivalent per day, approximately 58% of which was crude oil and natural gas liquids.

Source: press release