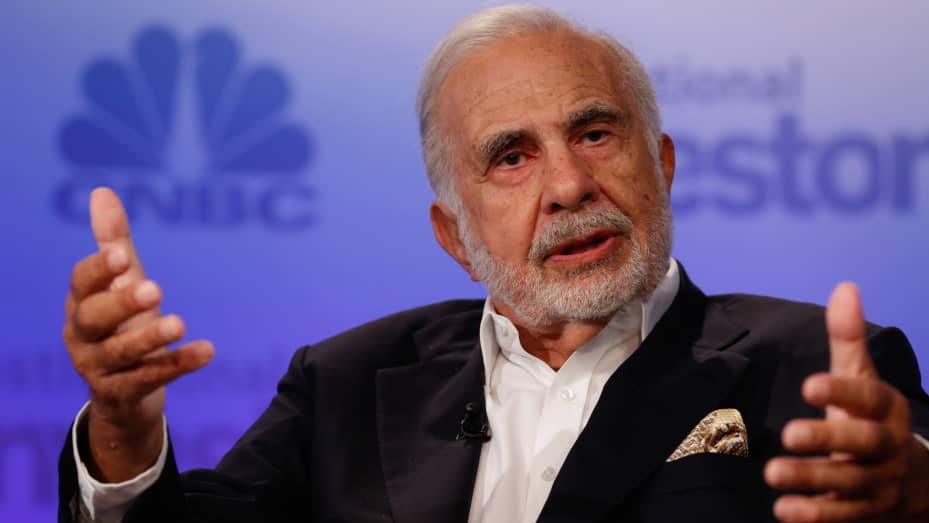

Activist investor Carl Icahn, yes the same one who holds controlling interest in Oklahoma City’s SandRidge Energy as well as CVR Energy tried but failed to convince Las Vegas-based Southwest Gas not to buy Dominion Energy’s Questar Pipeline in a $2 billion deal.

He revealed earlier Tuesday that he had a 4.9% stake in Southwest Gas and publicly objected to the utility’s acquisition. Hours later, Dominion announced the consummation of the deal, even after Icahn called the acquisition a mistake. Under the acquisition, which is expected to close in the fourth quarter, Southwest will assume near $430 million in debt.

Icahn contended the price was too high and the deal was coming when regulated utilities are dumping non-core assets and focusing on primary businesses.

“During the past few years, management of SWX has made a number of egregious errors at the expense of shareholders,” he wrote as he criticized Southwest’s poor governance and high costs.

Southwest supplies natural gas for more than 2 million customers in Arizona, Nevada and California. Questar Pipelines is a firm with long term contracts to transport gas and large underground storage assets in Utah, Colorado and Wyoming.