A new report is out detailing the fall in oil and gas production in Colorado’s DJ Basin.

Oil and Gas Shale Market Analysis and Outlook to 2025 offers a review of the oil and gas appraisal and development in the shale play against the backdrop of COVID-19 pandemic.

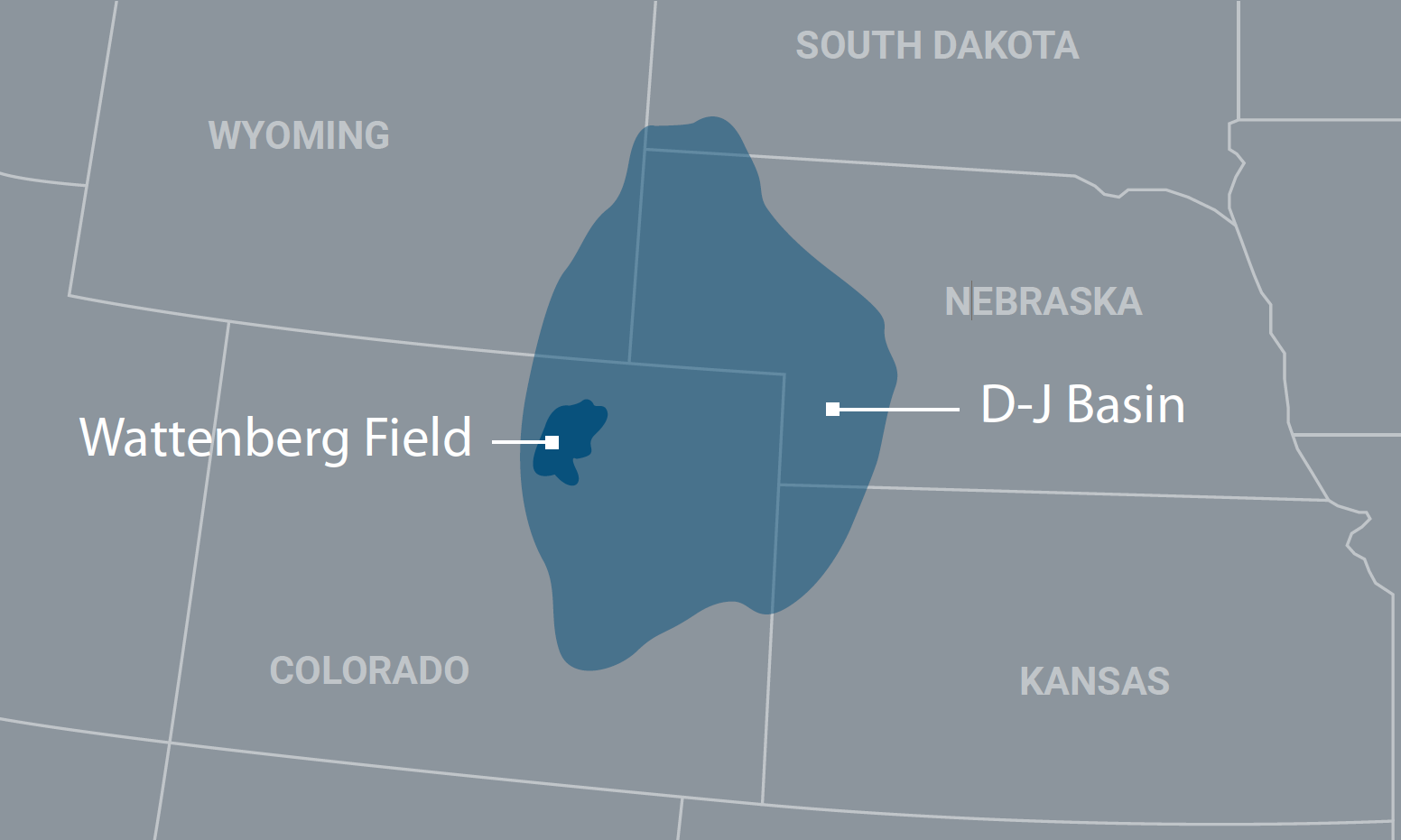

The DJ Basin, located in Colorado and Wyoming, accounted for 7.02% of oil and 6.65% of natural gas production in the United States Lower 48 in 2020. The play peaked in production in November 2019, with 801.5 thousand barrels of oil per day (mbd) and 5.8 billion cubic feet per day (bcfd) of natural gas. Since then, it has experienced a constant decline even before the effect of Covid-19.

COVID-19 outbreak and subsequent restrictions on economic activities further affected the oil and gas production in DJ Basin. The DJ Basin averaged 53 drilling rigs in 2019 and then decreased to an average of 17 rigs a 68% drop in 2020. While other basins throughout the US have increased their rig count with commodity prices rising to pre-pandemic levels, the DJ Basin has lagged with its rig count.

Overall production is still declining in this region, while plays like the Permian Basin, Bakken, and Appalachia Basin have all seen an increase in production level in the second half of 2020 and first quarter of 2021. The publisher expects a slight uptick in the rig count and production but not the level that was seen in 2019.

The top two producers in the DJ Basin are Occidental Petroleum and Chevron. These two players have large positions in the Permian Basin where returns on investment are higher than the DJ Basin.