SandRidge Mississippian Trust II announced a distribution of approximately $6.2 million, or $0.125 per unit, reflecting the net proceeds received from the sale of the Trust’s assets to SandRidge Energy, Inc. on September 10, 2020.

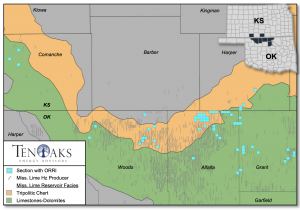

The trust owned royalty interests in the Mississippian formation in Alfalfa, Grant, Kay, Noble and Woods counties in northern Oklahoma and Barber, Comanche, Harper and Sumner counties in southern Kansas

The sale of the assets was previously disclosed, as well as the release of approximately $1.3 million of cash reserves previously withheld by the Trustee for the payment of future known, anticipated or contingent expenses or liabilities of the Trust.

The distribution is expected to occur on or before November 23, 2020 to holders of record as of the close of business on November 13, 2020 and is expected to be the final distribution to be made to the Trust unitholders.

The stock transfer books for the Trust units will be closed at the close of business on November 13, 2020. If any cash reserves remain following the payment of the Trust’s estimated remaining expenses and liabilities, the Trustee may make a final distribution to unitholders of such amount. Holders of record as of the close of business on November 13, 2020 will be entitled to such distribution, if any.

The Trust will remain in existence until the filing of a certificate of cancellation with the Secretary of State of the State of Delaware following the completion of the winding up process.

Meanwhile, the SandRidge Mississippian Trust I announced it would have no distribution paid for the three-month period ending Sept. 30, 2020. Like the SandRidge Mississippian Trust II, Trust 1 will be dissolved this year as well because of dwindling royalties.

As described in the Trust’s annual and quarterly reports filed with the Securities and Exchange Commission (the “SEC”), the trust agreement governing the Trust requires the Trust to dissolve and commence winding up of its business and affairs if cash available for distribution for any four consecutive quarters, on a cumulative basis, is less than $1.0 million.

As cash available for distribution for the four consecutive quarters ended September 30, 2020, on a cumulative basis, will total approximately $815,000, the Trust will be required to dissolve and commence winding up beginning as of the close of business on November 13, 2020 (the “dissolution trigger date”). Accordingly, the Trustee will be required to sell all of the Trust’s assets, either by private sale or public auction, and distribute the net proceeds of the sale to the Trust unitholders after payment, or reasonable provision for payment, of all Trust liabilities.

Source: BusinessWire