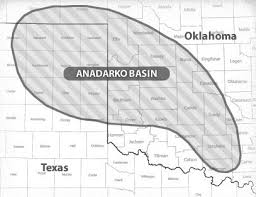

First ConocoPhillips sold its San Juan basin assets for $3 billion. Now BP American Production Co. is considering pulling out of the same region and the economic impact in Southwest Colorado and northern New Mexico won’t be good. And BP plans to sell its assets in the Anadarko Basin in Oklahoma and the Texas Panhandle. It will also sell assets in Oklahoma’s Arkoma Basin.

Dave Lawler, BP’s Chief Executive Officer of the company’s U.S. Lower 48 Onshore operations, notified employees by letter this week that BP will sell assets in the San Juan Basin.

In a letter sent Tuesday to employees, Dave Lawler, BP’s Chief Executive Officer of its U.S. Lower 48 Onshore business, announced plans to sell assets in the San Juan Basin, as well as the Anadarko Basin in Oklahoma and Texas, and the Arkoma Basin in Oklahoma.

The letter was anonymously leaked to The Durango Herald and confirmed by BP officials.

Lawler wrote that BP “intends to sell” assets in these natural gas and oil fields as part of a plan to divest $5 to $6 billion to help fund the purchase of U.S. shale oil and gas assets from global miner BHP Billiton.

BP’s purchase of BHP’s assets for $10.5 billion was announced in July and marked a major turning point for BP, which will increase its onshore oil and gas resources by 57 percent.

“This has been one of the most difficult decisions of my career, and I announce it with mixed emotions,” Lawler, who became CEO four years ago, wrote in his letter to employees.

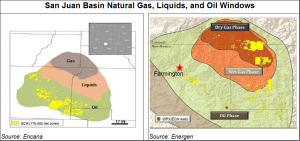

The San Juan Basin is a natural gas and oil field that spans across northern New Mexico and Southwest Colorado. It was once one of the leading producers of natural gas in the country.

Discovered in the early 1920s, the San Juan Basin is one of the oldest producing areas in the U.S., but the field didn’t flourish until the 1990s. Now, there are more than 30,000 wells in the basin.

But production has waned since the mid-2000s, largely attributed to lower global prices and the discovery of other energy fields where it is easier and cheaper to operate.

The largest companies operating in the San Juan Basin have dropped in recent years. ConocoPhillips sold its stake in the region for $3 billion in 2016. And earlier this month, Williams Partners sold its assets for $1.125 billion.

Despite the downturn in the basin, BP has remained an economic mainstay.

The company’s production of natural gas, according to state records, has remained consistent since 2013, after a dip from the peak years between 2000 and 2011 when the industry was booming.

In 2017, BP accounted for more than half of the total natural gas production in La Plata County, and 75 percent of new drilling permits. That year, BP produced more than 162 million cubic feet.

The next highest operating was the Southern Ute Indian Tribe’s Red Willow Production Co. at 52 million cubic feet and XTO Energy at 14 million cubic feet.

BP has also made significant investments to modernize and update its equipment on the field, and has tested new technologies in the area. It also planned to move its offices to downtown Durango.

Brett Clanton, a spokesman for BP, said there are no immediate changes to the company’s operations in La Plata County.

“All of those pending permits, plans to move the office – all that is business as usual,” Clanton said.

Lawler wrote to employees that BP is entering the beginning of a sales process that could take up to two years, and that a particular asset may not be sold if the company cannot obtain a price it deems appropriate.

“Therefore, it is critical that we continue working in a safe and efficient manner, and that we continue filing permits and generating development plans,” Lawler wrote.