The merger of Devon Energy with Coterra Energy came as expected early Monday —an all-stock transaction with a value of $58 billion. But it will mean the loss of the headquarters which will be transferred to Houston, Texas. Still unanswered is just how many Devon employees might be lost in a move of the headquarters.

The deal creates a major U.S. shale producer and together, the two firms will have combined production exceeding 1.6 million barrels of oil equivalent a day.

“This transformative merger combines two companies with proud histories and cultures of operational excellence, creating a premier shale operator,” said Clay Gaspar, Devon’s President and CEO.

“We’ve now built a diverse asset base of high-quality, long duration inventory to drive resilient value creation and returns for shareholders through cycles. Underpinned by our leading position in the best part of the Delaware Basin, and a deep set of complementary assets, we expect to capture annual pre-tax synergies of $1 billion. This will drive higher free cash flow and greater shareholder returns beyond what either company could achieve alone.”

He further state during a conference call, “This merger unites 2 highly competitive portfolios, creating a must-own premier shale operator. But this is more than just about size. Devon and Coterra bring together substantial and overlapping positions across the best shale basins, creating a portfolio built for durability and designed to deliver top-tier shareholder returns for decades to come. At the heart of this combined portfolio is our leading position in the Delaware Basin, which generates more than half of our total production and cash flow backed by over a decade of top-tier drilling inventory.”

The combined company will be named Devon Energy and will be headquartered in Houston while maintaining a significant presence in Oklahoma City. The formation of this premier company is expected to unlock substantial value by leveraging each company’s core strengths and through the realization of $1 billion in annual pre-tax synergies. The realization of synergies, technology-driven capital efficiency gains and optimized capital allocation will drive near and long-term per share growth.

The transaction, which was unanimously approved by the boards of directors of both companies, is expected to close in the second quarter of 2026, subject to regulatory approvals and customary closing conditions, including approvals by Devon and Coterra shareholders.

Following the merger, the board of directors will consist of 11 members, six directors from Devon and five from Coterra. Clay Gaspar will serve as President and CEO, and Tom Jorden will assume the role of Non-Executive Chairman of the Board. Devon will appoint the lead independent director. The CEO and executive leadership will be based in Houston with executive leadership comprised of talent from both Devon and Coterra.

Tom Jorden, Chairman, CEO, and President of Coterra said, “This combination enhances the Delaware and brings together two premier organizations with complementary cultures rooted in operational excellence, disciplined capital allocation, and data‑driven decision-making focused on creating per share value. The combined company will offer best-in-class rock quality and inventory depth, supported by a balanced commodity mix, leading cost structure, and a conservative balance sheet. Devon Energy will be strongly positioned to deliver top-tier capital efficiency gains and consistent profitable per share growth through the commodity cycles.”

During a conference call, he added, “We can never know what the future will bring. There will be challenges both seen and unforeseen. Oil and natural gas markets remained volatile and unpredictable. Commodity and geographic diversity position the company to be flexible and resilient for whatever the future brings. Now as always, flexibility is the coin of the realm. With this merger, Devon is positioned to be flexible and adaptable, more so than any of our peers. This will distinguish us as we move forward.”

He also called it the best thing to happen to Coterra.

“As one can imagine, we’ve looked at all kinds of potential futures for Coterra. We’ve always been opportunistic and open-minded on looking at many different options. This was the best one by far. This adds tremendous value for both shareholder bases. It creates an absolutely premier company that exposes our owners to the full upside. And this was by far the best option that we had considered. And we feel very confident that we considered a full range of opportunities.”

Under the terms of the agreement, Coterra shareholders will receive a fixed exchange ratio of 0.70 share of Devon common stock for each share of Coterra common stock. Based on Devon’s closing price on January 30, 2026, the transaction implies a combined enterprise value of approximately $58 billion. Upon completion, Devon shareholders will own approximately 54 percent of the go-forward company and Coterra shareholders will own approximately 46 percent on a fully diluted basis.

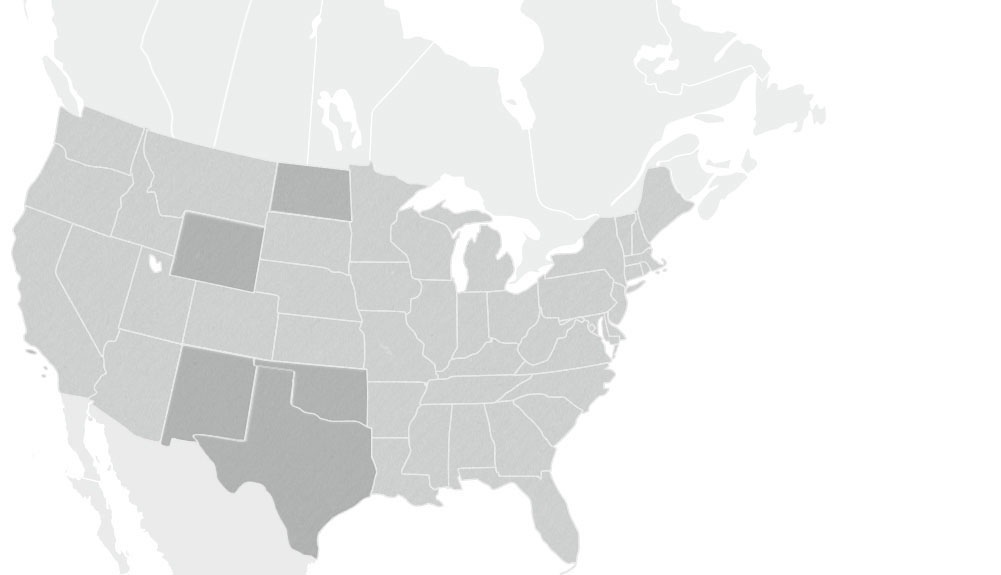

Where Devon has current operations.

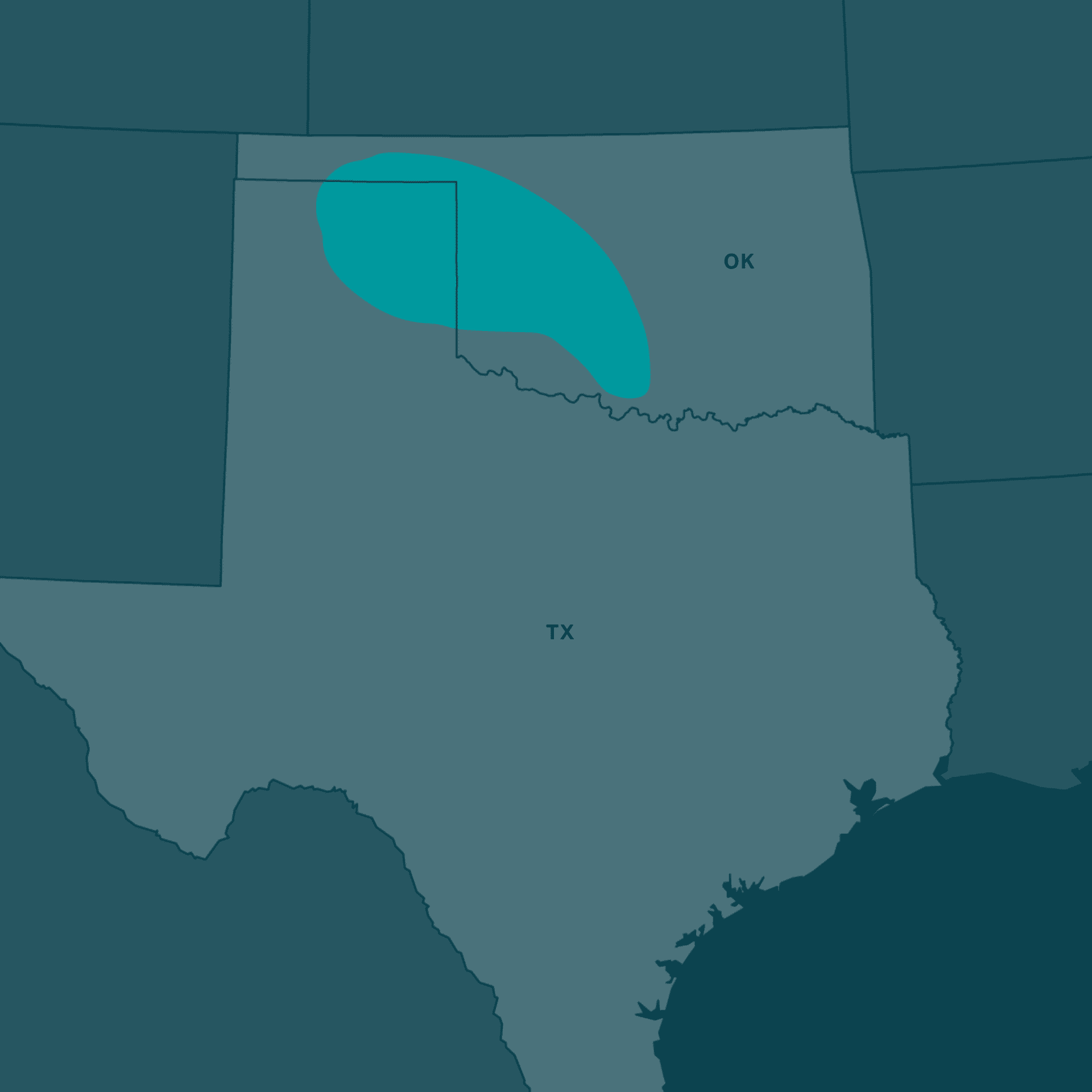

Coterra also operates in the Permian Basin as well as the Anadarko Basin in Oklahoma and the Marcellus play in West Virginia and Pennsylvania.

KEY HIGHLIGHTS

- Transformative merger combines high-quality assets and complementary technical capabilities

- Creates a scaled, large-cap E&P with leading inventory duration and durable free cash flow

- Devon to be a leader in the Delaware Basin, with more than 10 years of high-quality inventory

- $1.0 billion in identified pre-tax synergies projected to drive significant, annual free cash flow improvements

- Integration of technology platforms expected to materially enhance capital efficiency

- Accretive to key per-share financial measures, including free cash flow and net asset value

- Committed to returning capital to shareholders through a planned quarterly dividend of $0.315 per share and a new share repurchase authorization exceeding $5 billion, both subject to Board approval

- All-stock transaction enhances investment-grade financial strength and lowers future cost of capital

TRANSACTION BENEFITS

- Creates a premier large-cap shale operator – The merger will create one of the world’s leading shale producers, with pro forma third quarter 2025 production exceeding 1.6 million barrels of oil equivalent (Boe) per day, including over 550 thousand barrels of oil per day and 4.3 billion cubic feet of gas per day. The combined company’s portfolio will be anchored by world-class acreage in the Delaware Basin, complemented by a balanced and diversified product mix that positions the company to deliver a resilient free cash flow profile.

- Expands the Delaware, America’s premier basin – The combined company will be one of the largest producers in the Delaware Basin, with pro forma third quarter 2025 production of 863,000 Boe per day distributed across nearly 750,000 net acres in the core of the play. This franchise asset will account for more than 50 percent of the combined company’s total production and cash flow, underpinned by more than 10 years of top-tier inventory, including the largest amount of sub-$40 inventory in the industry.

- Delivers significant cost synergies – The company expects to achieve $1.0 billion in annual pre-tax merger synergies by year-end 2027. Synergies to be realized through an optimized capital program, operating margin improvements, and streamlined corporate costs. The all-stock structure of the transaction ensures shareholders of both Devon and Coterra will fully benefit from this value creation.

- Technology-focused leader – The combined AI capabilities of both organizations will establish an strong technology platform across subsurface, operations, and enterprise functions. AI-driven optimization will enhance capital efficiency, operational performance, and decision-making at scale.

- Accretive to financial metrics – The transaction is expected to be accretive to all shareholders on key per-share financial measures, including free cash flow and net asset value.

- Accelerates shareholder returns – The company’s strong financial foundation combined with accretion from synergy capture will allow for the acceleration of cash returns to shareholders. Upon closing, the company plans to declare a quarterly dividend of $0.315 per share and establish a new share repurchase authorization in excess of $5 billion, both subject to Board approval.

- Maintains fortress balance sheet – Enhanced economies of scale and an investment-grade balance sheet are expected to lower the company’s future cost of capital. The company has one of the strongest capital structures in the sector, with an estimated pro forma net debt-to-EBITDAX ratio of 0.9x and $4.4 billion in total pro forma liquidity as of September 30, 2025.

Share prices of each firm fell throughout the day.