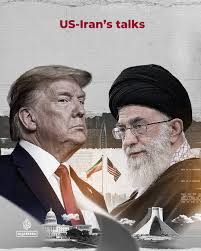

Crude oil prices split their results on Friday as the clock is ticking on President Trump’s deadline for Iran to come to a decision about ending its nuclear weapon development. One recorded a slight gain while another ended with a slight loss.

The gain was recorded late in the trading day as Brent and WTI were down for most of the day. “We’re caught in between anticipation what’s going to happen with the U.S. and Iran and denial an attack’s going to happen,” said one analyst.

As for the U.S. Supreme Court decision that ruled unconstitutional President Trump’s use of a law to levy tariffs in national emergencies, the markets apparently shrugged off any serious reaction.

West Texas Intermediate ended with a 4 cent drop or 0.06% at $66.39 a barrel on the New York Mercantile Exchange.

Brent crude closed up 10 cents or 0.14% at $71.76 a barrel.

Despite the weak reaction on Friday, Brent and WTI were still up more than 5% for the week.

Natural gas prices rose on the last day of trading for the week, settling up at $3.047 MMBtu after a gain of $0.051 or 1.70%.