Oklahoma Gross Production Tax Jumps 232% in December

Oil and Gas Revenues Drive Strong Monthly Gains

Revenue from Oklahoma Gross Production Tax surged in December, helping push overall state collections sharply higher, according to the latest monthly revenue report from Todd Russ.

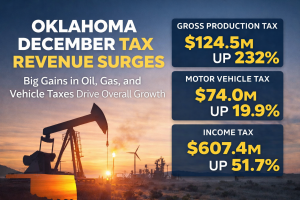

The gross production tax on oil and gas increased by $124.5 million, representing a 231.6% jump compared to the prior month. The increase reflects stronger energy receipts at the end of the year and underscores the continued importance of Oklahoma’s oil and gas sector to state finances.

Motor Vehicle and Income Taxes Also Rise

Energy was not the only driver of December’s revenue growth.

-

Motor vehicle tax collections rose $74.0 million, an increase of 19.9%

-

Total income tax collections climbed to $607.4 million, up 51.7% month over month

Together, those gains helped offset softness in other areas of state tax collections.

Sales Tax Declines Despite Overall Growth

While several revenue streams increased, sales and use tax collections slipped in December.

-

Total sales and use tax: $610.8 million, down 2.7%

-

Other tax sources: $117.7 million, down 9.8%

Even with those declines, overall collections remained strong due to the outsized gains in income, energy, and vehicle-related taxes.

State Revenue Up Nearly 2% Over Past Year

Looking at the broader picture, Oklahoma’s total state revenue over the past 12 months reached $17.20 billion, an increase of $326.4 million, or 1.9%, compared to the prior year.

On a year-over-year monthly basis, December collections were up $120 million, representing an 8.5% increase. Compared with November, overall revenue rose 22.0%, highlighting the strength of December’s inflows.

Energy Remains a Key Revenue Driver

The sharp rise in gross production tax collections illustrates how closely Oklahoma’s fiscal health remains tied to oil and gas activity, even as the state continues to diversify its revenue base.

Treasury officials did not attribute the December spike to a single factor, but the increase aligns with higher production values and timing effects often seen at year-end in energy-related tax reporting.