Coterra maintains Oklahoma presence

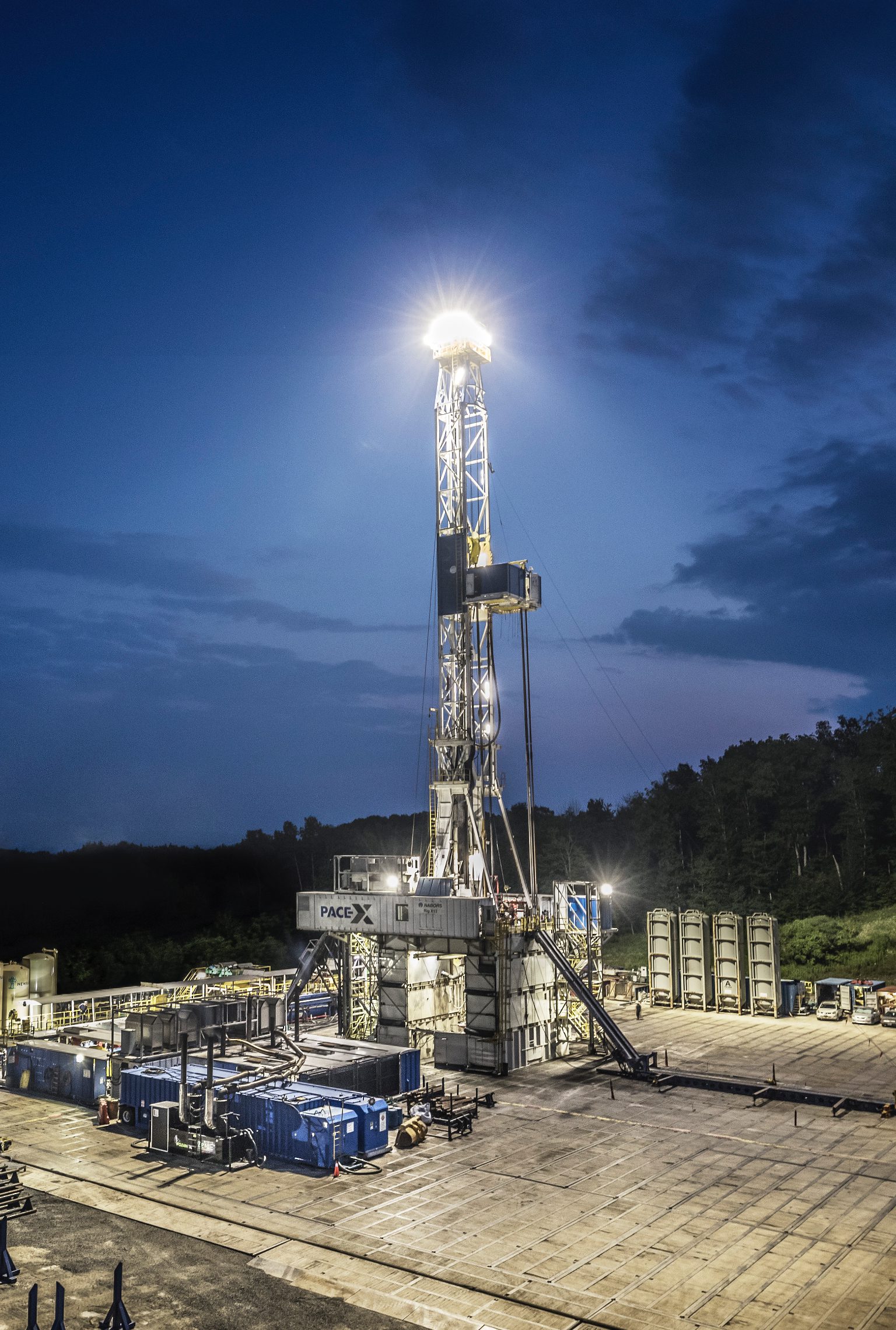

With only one drilling rig active in Oklahoma, COTERRA Energy remains a player in the state’s oil and gas industry.

Additionally, Oklahoma Energy analysts continue tracking Coterra’s minimal-rig strategy value impact.

Quarterly drilling performance

In its third quarter financial report issued this week, the Houston-based company reported turned in-line 48 net wells during the quarter.

Also, drilling cadence remains aligned with multi-basin development pacing.

In the Permian, 38 net wells were turned in-line, slightly below the guidance of 40 to 50 net wells.

Meanwhile, Anadarko and Marcellus turned in-line six and four net wells, respectively, in line with guidance.

Financial results + cash generation

The company, with nine rigs in the Permian and one to two in the Marcellus, recorded net income of $322 million or 42 cents a share along with adjusted net income of $312 million and 41 cents a share.

Therefore, margin stability remains anchored by multi-region drilling contribution.

COTERRA’s operating activities produced $971 million in cash flow and a discretionary cash flow of $1,148 million while free cash flow came to $533 million.

Additionally, this strong free cash performance continues reinforcing capital discipline confidence.

CEO commentary

Tom Jorden, Chairman, CEO and President of COTERRA, noted, “We are pleased with our strong operational execution during the quarter and are on track to meet or exceed our annual targets.”

Finally, consistent operational execution continues to shape investor confidence into year-end.

“Our nine rig and three completion crew program in the Permian program continues to be highly capital efficient, cost effective, and is generating strong returns at today’s prevailing prices. We are also pleased with the competitive returns currently being generated in both the Marcellus and Anadarko Basin. The durability of our high-quality asset portfolio shines throughout various price cycles.”

Key Takeaways & Updates

- For the third quarter of 2025, total BOE (barrels of oil equivalent), natural gas production, and oil production all neared the high-end of our guidance ranges, with all streams beating their respective mid-points by approximately 2.5%. Incurred capital expenditures (non-GAAP) totaled $658 million, near the mid-point of our guidance range of $625 to $675 million.

- Increasing full-year 2025 total equivalent and natural gas production guidance and tightening the range around oil production guidance. Continue to expect 2025 capital expenditures (non-GAAP) around $2.3 billion, which assumes we continue to run nine rigs in the Permian, one to two rigs in the Marcellus, and one rig in the Anadarko during the fourth quarter. This delivers a full year 2025 reinvestment rate, defined as incurred capital expenditures as a percentage of Discretionary Cash Flow (non-GAAP), of approximately 55%.

- Expect 2025 Free Cash Flow (non-GAAP) of approximately $2.0 billion, at recent strip prices.

- Third-quarter 2025 declared dividend of $0.22 per share, or approximately $168 million on a cash basis. Additionally, the Company continued to prioritize debt repayment, repaying $250 million of term loans during the quarter. Coterra remains committed to reducing its leverage and maintaining its top-tier balance sheet. In addition, the Company resumed repurchasing its shares opportunistically in the fourth quarter.

- Coterra has accelerated its leasing ground game in 2025, acquiring $86 million of leasehold year-to-date, in addition to our customary acreage trade optimizations.

- Looking ahead, based on current expectations, the Company anticipates 2026 capital expenditures modestly down from 2025, while maintaining 0-5% annual BOE growth, and approximately 5% annual oil growth. Based on recent strip prices, the Company expects its 2026 reinvestment to be at, or below, 50%.

Third-Quarter 2025 Highlights

- Net Income (GAAP) totaled $322 million, or $0.42 per share. Adjusted Net Income (non-GAAP) was $312 million, or $0.41 per share.

- Cash Flow From Operating Activities (GAAP) totaled $971 million. Discretionary Cash Flow (non-GAAP) totaled $1,148 million. Free Cash Flow (non-GAAP) totaled $533 million.

- Cash paid for capital expenditures for drilling, completion, and other fixed asset additions (GAAP) totaled $615 million. Incurred capital expenditures from drilling, completion, and other fixed asset additions (non-GAAP) totaled $658 million, within our guidance range of $625 to $675 million.

- Unit operating cost (reflecting costs from direct operations, transportation, production taxes and G&A) totaled $9.81 per BOE, slightly above the mid-point of our annual guidance range. The Company expects fourth quarter per unit costs to trend closer to the mid-point of our annual guidance range.

- The Company turned in-line 48 net wells during the quarter. In the Permian, 38 net wells were turned in-line, slightly below our guidance of 40 to 50 net wells. Anadarko and Marcellus turned in-line six and four net wells, respectively, in line with guidance.

- Total equivalent production averaged 785.0 MBoepd (thousand barrels of oil equivalent per day), near the high end of guidance (740 to 790 MBoepd).

- Oil production averaged 166.8 MBopd (thousand barrels of oil per day), near the high end of our guidance range (158 to 168 MBopd).

- Natural gas production averaged 2,894.6 MMcfpd (million cubic feet of gas per day), near the high end of guidance (2,750 to 2,900 MMcfpd).

- NGLs production averaged 135.8 MBopd.

- Realized average prices:

- Oil was $64.10 per Bbl (barrel), excluding the effect of commodity derivatives, and $64.79 per Bbl, including the effect of commodity derivatives.

- Natural Gas was $1.95 per Mcf (thousand cubic feet), excluding the effect of commodity derivatives, and $2.05 per Mcf, including the effect of commodity derivatives.

- NGLs were $17.02 per Bbl.

Shareholder Return Highlights

- Common Dividend: On November 3, 2025, Coterra’s Board of Directors approved a quarterly dividend of $0.22 per share, equating to a 3.8% annualized yield, based on the Company’s $23.40 closing share price on October 30, 2025. The dividend will be paid on November 26, 2025 to holders of record on November 13, 2025. This will bring total dividends for the year to $504 million (cash basis) and total shareholder returns to nearly $551 million, through September 2025.

- Share Repurchases: As of September 30, 2025, $1.1 billion remains on the Company’s $2.0 billion share repurchase authorization. No shares were repurchased during the third quarter as the Company focused on the repayment of its term loans. The Company resumed share repurchases in October and expects to continue to opportunistically repurchase its shares in the fourth quarter.

- Reiterate Shareholder Return Strategy: Coterra remains committed to robust shareholder returns and expects to return 50% or greater of Free Cash Flow (non-GAAP) to shareholders through the cycles. Year-to-date, after payment of its base dividend, the Company prioritized debt reduction, retiring $600 million of the $1.0 billion term loans issued earlier in the year, associated with the Company’s Delaware Basin acquisition. During the fourth quarter, the Company restarted its share repurchase program. The Company will remain committed to debt reduction and opportunistic share repurchases.

Guidance Updates

- Continue to expect 2025 incurred capital expenditures (non-GAAP) around $2.3 billion.

- Increasing 2025 full-year guidance, including increasing total equivalent production range up to 772 to 782 MBoepd and natural gas production range up to 2,925 to 2,965 MMcfpd. Tightening the range around 2025 oil production to 159 to 161 MBopd.

- Announcing fourth-quarter 2025 guidance, including total equivalent production of 770 to 810 MBoepd, oil production of 172 to 178 MBopd, natural gas production of 2,775 to 2,925 MMcfpd, and capital expenditures (non-GAAP) of approximately $530 million.

- Estimate full-year 2025 effective tax rate of 22% and no cash taxes during fourth-quarter 2025.

- For more details on annual and fourth-quarter 2025 guidance, see 2025 Guidance Section in the tables below.

Strong Financial Position

In conjunction with the closing of the Franklin Mountain Energy and Avant Natural Resources acquisitions in late January, Coterra issued $1.0 billion of new debt through its term loan agreements. Subsequently, Coterra has paid down $600 million of the term loans through September 2025, including $250 million in the third quarter, leaving $400 million of term loan debt outstanding. As of September 30, 2025, Coterra had total debt outstanding of $3.9 billion (principal balance), down from $4.5 billion in January 2025. The Company exited the quarter with cash and cash equivalents of $98 million, and no debt outstanding under its $2.0 billion revolving credit facility, resulting in total liquidity of approximately $2.1 billion. Net Debt to trailing twelve-month Adjusted Pro Forma EBITDAX ratio (non-GAAP) at September 30, 2025 was 0.8x, pro forma for the Franklin and Avant acquisitions. The Company remains committed to further near-term debt reduction.