A study by researchers at the Dallas Federal Reserve Bank concluded that lithium developers are facing some tough economic challenges as they attempt to meet U.S. expectations to reduce reliance on China-dominated supply chains.

The report identified 66 of such efforts across the nation to bring new lithium projects online but it did not include the move by Stardust Power, the Connecticut company that is in the process of construction a lithium refinery in Muskogee, Oklahoma. Release of the study by Michael Plante and Isabelle Tseng at the Federal Reserve Bank also came as Stardust Power announced this week the appointment of a new executive in charge of construction of the eastern Oklahoma refinery.

“Growth prospects beyond 2030 will hinge not only on the evolution of lithium prices, currently quite low, but also on the abilities of companies to scale up new technologies and navigate myriad challenges that frequently derail mining projects.

The future may also depend critically on the actions of the federal government, which in recent years has played a key supporting role in advancing some lithium projects.”

Below is the full report:

Commercial interests are striving to bring new lithium projects online in the U.S. at a time of growing desire to reduce reliance on China-dominated supply chains and with expectations that global demand could double over the next five years.

We identify 66 of these projects spread across the U.S., many in the early stages of development. Several are currently under construction and, assuming successful completion, these would boost U.S. lithium production tenfold by the end of the decade.

Growth prospects beyond 2030 will hinge not only on the evolution of lithium prices, currently quite low, but also on the abilities of companies to scale up new technologies and navigate myriad challenges that frequently derail mining projects.

The future may also depend critically on the actions of the federal government, which in recent years has played a key supporting role in advancing some lithium projects.

Lithium projects cluster near resources, unconventional sources

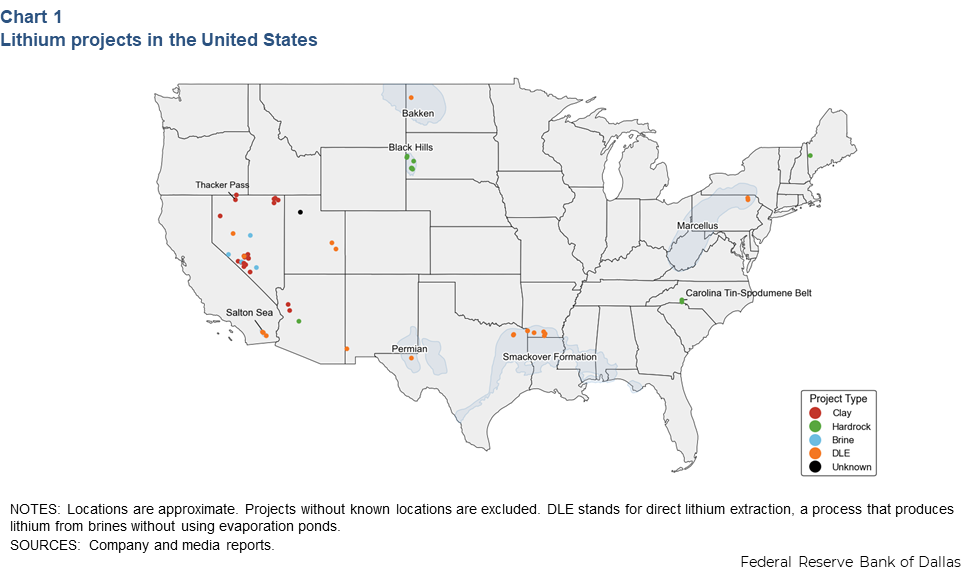

U.S. lithium projects are concentrated in a small number of states, often where resource quality is high or preexisting infrastructure potentially improves the economics (Chart 1).

Nevada hosts the most lithium projects, followed by the Smackover Formation in Arkansas and East Texas. Smaller clusters are in Arizona, California’s Salton Sea, South Dakota’s Black Hills, Utah and shale basins such as the Bakken in North Dakota, the Marcellus in Pennsylvania and the Permian of Texas and New Mexico.

Globally, lithium is produced through two methods: extracting lithium-rich brine from underground aquifers and concentrating it in evaporation ponds, or hard-rock mining of pegmatite rock for minerals such as spodumene. The only operating lithium mine in the U.S., Silver Peak in Nevada, uses evaporation ponds. Hard-rock mining was historically done in North Carolina and South Dakota. Only a small fraction of identified U.S. projects could use either method.

About 70 percent of U.S. projects instead target alternative sources. This offers the prospect of large, untapped resources but also the challenge of scaling up commercially unproven technologies and production processes.

The largest group, comprised of 25 projects, focuses on sedimentary (clay) deposits, primarily in Nevada, where rare geology and environmental conditions yield exceptionally high lithium concentrations in soils and underground brines.

Twenty-one projects propose to use direct lithium extraction, a set of technologies that produce lithium from brines without evaporation ponds. The locations involve diverse brine sources: hot, mineral-rich geothermal brines in California, deep underground brines in Nevada and Utah, and produced water, a byproduct of oil and gas wells in shale basins in Pennsylvania, North Dakota and West Texas.

Within this group, the Smackover Formation, an oilfield that began producing in the 1920s, has emerged as a hotspot, with activity focused on East Texas and Arkansas. Its brines have exceptionally high lithium concentrations, drawing interest from U.S. integrated oil companies, such as ExxonMobil and Chevron, and Norwegian oil and renewable energy company Equinor. The region also benefits from a history of producing chemicals from brines and the applicability of conventional drilling methods for extracting those brines.

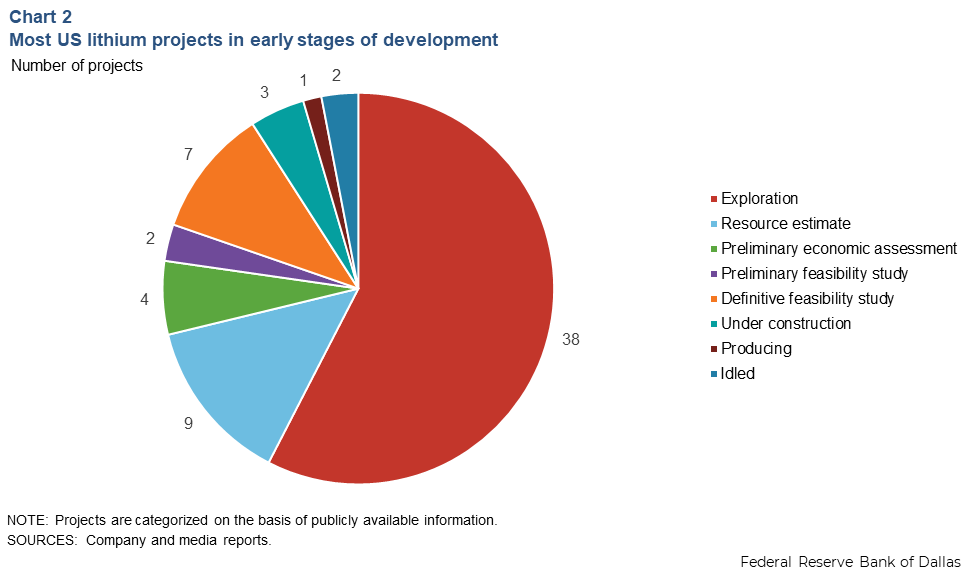

Many projects in early development phase

Developing a lithium project can take a decade or more, with many typically moving through well-defined stages. Companies first acquire the rights to assess the resource in a specific area. Over half of the identified projects are in this initial exploration phase (Chart 2). Success is uncertain, as the deposit may end up being marginal or market conditions may become unfavorable.

Most projects that advance beyond this first stage subsequently release increasingly detailed reports. These range from a resource estimate, a precursory estimate of the size and quality of the resource, to a definitive feasibility study, which provides numerous details about the project, including expected capital costs and profitability. Only 10 percent of the projects identified are currently at that stage.

Even at that point, reaching commercial production is not guaranteed. A company must also acquire the necessary federal and state permits, an often time-consuming process. This is particularly true at the federal level, which applies to many projects in the West, although federal officials are attempting to streamline the process. Finally, project sponsors must secure financing for capital costs that often total billions of dollars. Once both are in place, the project can reach a final investment decision and begin construction, which may last several years.

U.S. production set to increase

Amid these challenges, three projects were officially under construction as of August 2025. The largest, Thacker Pass in Nevada, is an open-pit clay mine, and first-phase production is scheduled to begin in late 2027. At capacity, the first phase will produce about 40,000 tons of lithium annually, sufficient to power about 700,000 to 800,000 electric vehicles. This reflects a substantial increase relative to U.S. production in 2024, which was about 4,000 tons (less than 1 percent of world production). Two smaller projects in East Texas and Pennsylvania aim to start production in 2026. Their combined initial production will be less than 10,000 tons.

Publicly available information points to other projects that could come online by 2030, although whether these will reach commercial production is far less certain. Two are now working toward a final investment decision, while a handful are advanced enough that, under the right conditions, they could enter commercial production by the end of the decade. The combined output of these projects would exceed 100,000 tons.

Importantly, these projects are often designed to produce the specific lithium chemicals used in lithium-ion batteries, lithium carbonate or lithium hydroxide, rather than intermediate lithium products. These intermediate products, such as lithium chloride, would require additional processing, likely requiring shipment to China and exposure to the very supply chain many sponsors hope to avoid.

Long-term outlook more uncertain

The trajectory of U.S. lithium production is less clear beyond the next five years. Even with a substantial resource base, investment will only occur if the expected returns justify the risks, and many projects face substantial hurdles to reach commercial production.

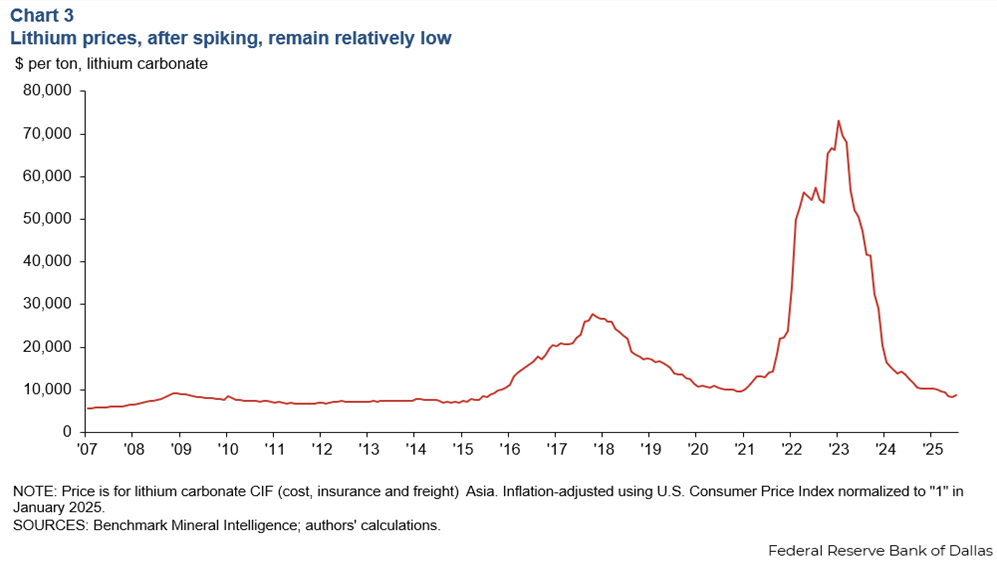

Low lithium prices are one major headwind. Prices have dropped sharply from record highs (Chart 3) . This reflects both a substantial increase in supply and a reassessment over the past few years about the pace of demand growth.

Prices are now below what is needed to cover operating expenses at many already producing mines outside the U.S., leading to shut-ins. This has also caused companies in the U.S. and elsewhere to slow work on new projects. While prices will need to increase to encourage new supply, the timing and scale of such an increase remains uncertain.

Compounding that uncertainty, most U.S. lithium projects require massive upfront investment. The first phase of Thacker Pass, for example, is expected to cost $3 billion, while expected costs for other large clay and direct lithium extraction projects often exceed $1 billion.

These are large numbers in absolute terms and often in relative terms to other potential lithium projects outside the U.S. Such projects also feature potentially long payoff periods, with many feasibility studies reporting up to five years after the start of production, often based on lithium prices double the current market.

Some have cost-saving strategies but those often involve trade-offs. California direct lithium extraction projects aim to co-locate with geothermal power plants, but the brines can be difficult to manage because of extreme heat and their sometimes corrosive quality. In shale basins, companies hope to use water produced from existing oil and gas wells, avoiding the need for new drilling. However, the basins usually have low lithium concentrations.

These projects also risk opposition from local constituents. In Nevada and the broader West, water scarcity is a major issue, while other projects raise concerns about noise, pollution or adverse effects on local economic activity. These challenges are not insurmountable but add risk to advancing projects to commercial production.

Government support poses wildcard to outlook

Government support could prove decisive in determining which projects move forward and, therefore, to what extent U.S. production grows. Indeed, federal interest in securing domestic production has already shaped the industry through billions in subsidized loans and grants and with policies intended to boost demand for domestically produced lithium.

Recent policy shifts have led to some retrenchment but have also introduced the possibility of new forms of assistance, such as price floors or direct capital investment in firms. Financial support of this type, or additional loans or grants, could materially shift the direction of U.S. production levels, especially if lithium prices remain low or companies encounter difficulties scaling up projects focused on unconventional resources.

This support, of course, is not a free lunch in the economic sense. Instead, it builds in a trade-off between the more uncertain outcomes and relatively higher costs associated with domestic lithium production versus the potential insurance against the risk of future lithium supply chain disruptions.

Source: Dallas Federal Reserve Bank