Oil Prices Steady After Russia Fuel Export Ban

Oil prices steadied Thursday after hitting a seven-week high in the previous session, as Russia fuel exports ban extended through year-end balanced market optimism.

Russia Restricts Fuel Exports

Russian Deputy Prime Minister Alexander Novak confirmed the country will extend its gasoline export ban and impose a partial ban on diesel exports until the end of 2025. The move follows a string of Ukrainian drone attacks on Russian refineries that disrupted fuel output.

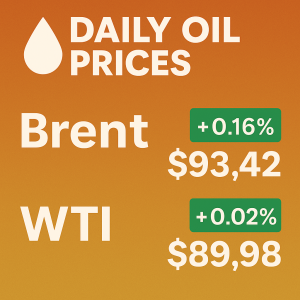

The decision gave oil prices support, but investors remained cautious. On Wednesday, both Brent and WTI benchmarks jumped 2.5% after U.S. crude inventories dropped unexpectedly and Ukraine escalated attacks on Russian energy assets.

-

Brent crude settled 11 cents higher at $69.42 per barrel

-

WTI crude slipped 1 cent to $64.98 per barrel

U.S. Economic Data Limits Gains

Fresh U.S. economic data tempered oil’s rally. The Commerce Department reported GDP grew at a 3.8% annualized rate last quarter. The upward revision dampened hopes of aggressive interest rate cuts, slightly offsetting supply concerns from Russia’s announcement.

Oil Prices Stock Movement

Oklahoma and U.S. energy stocks showed mixed performance Thursday:

-

Devon Energy Corp rose 1.56% to $35.76

-

Gulfport Energy climbed 1.41% to $176.54

-

Expand Energy Corp gained 1.24% to $104.38

-

Helmerich & Payne slipped 1.31% to $21.91

-

OGE Energy Corp fell 0.49% to $45.09

Outlook

Analysts say Russia’s move adds a layer of uncertainty heading into the winter. While U.S. growth remains steady, global supply risks could keep oil prices volatile in the coming months.