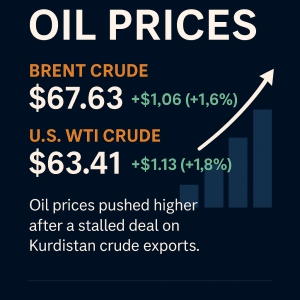

Oil prices climbed Tuesday as a stalled deal to restart crude exports from Iraq’s Kurdistan region helped ease investor fears about oversupply. The development gave energy markets a boost after several days of declines.

Global Benchmarks Rebound

Brent crude futures settled up $1.06, or 1.6%, to $67.63 a barrel. U.S. West Texas Intermediate (WTI) crude rose $1.13, or 1.8%, closing at $63.41. Both benchmarks had slipped earlier in the day but quickly regained ground.

For context, both Brent and WTI had fallen for four consecutive sessions, losing around 3% last week.

Kurdistan Export Deadlock

Pipeline exports from Kurdistan to Turkey have remained halted since March 2023. The suspension blocks about 230,000 barrels per day from reaching global markets.

The federal government of Iraq, the Kurdistan Regional Government, and oil firms had struck a deal to resume exports. However, two key producers refused to restart flows without guarantees of debt repayment. Until then, crude will remain locked in the region, tightening supply and supporting prices.

Market Impact and Investor Sentiment

Analysts note the stalemate temporarily calms worries about oversupply but keeps geopolitical uncertainty alive in the oil market. Investors remain cautious as OPEC+ output policies and global demand growth continue to weigh on sentiment.

Oklahoma Energy Stocks See Gains

Oklahoma-based firms mirrored the upward trend:

-

Alliance Resource Partners LP – 23.81 USD (+0.54 / 2.32%)

-

Coterra Energy Inc – 23.47 USD (+0.36 / 1.56%)

-

Devon Energy Corp – 34.48 USD (+0.76 / 2.25%)

-

Empire Petroleum Corp – 4.59 USD (+0.040 / 0.88%)

-

Expand Energy Corp – 100.72 USD (+2.46 / 2.50%)

The sector’s resilience reflects renewed optimism despite international uncertainty.