The Board of Directors at SandRidge Energy, Inc. has been increased from five to six members.

The decision was reached July 18 and according to a filing with the Securities and Exchange Commission, the new board member is Brett Icahn. His appointment will be effective Aug. 1, 2025.

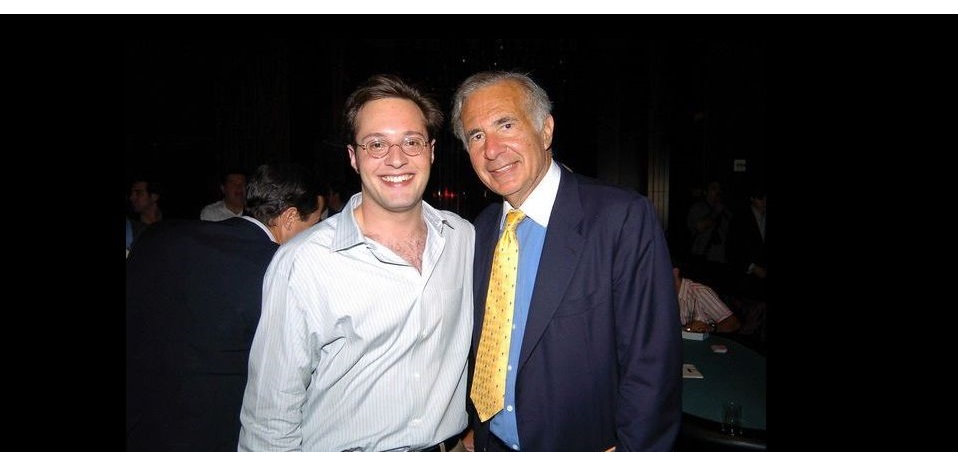

The 45-year old Icahn, a son of Carl Icahn, is a member of the board of Icahn Enterprises L.P. and also a Portfolio Manager at Icahn Capital LP, a subsidiary of Icahn Enterprises.

Icahn Enterprises is a diversified holding company engaged in a wide range of sectors, including investment, automotive, energy, food packaging, metals, real estate, and home fashion. Since October 2020, Brett Icahn has played a leading role in managing the investment strategy for Icahn Capital. Prior to that, from 2017 to 2020, he served as a consultant to Icahn Enterprises, where he provided exclusive investment advice to Carl C. Icahn, focusing on capital allocation across the firm’s operating subsidiaries and investment portfolio.

In addition to the board of Icahn Enterprises L.P., the younger Icahn currently serves on the board of Bausch Health Companies Inc. (since March 2021), and on the board of Bausch + Lomb Corporation (since June 2022). In the last five years, he previously served on the boards of Dana Inc. and Newell Brands Inc. Prior to then, Mr. Icahn has previously served on the boards of American Railcar Industries, Inc., Cadus Corporation, Nuance Communications, Inc., TakeTwo Interactive Software Inc., The Hain Celestial Group, Inc., and Voltari Corporation (previously known as Motricity Inc.).

The SEC filing added that known for his analytical rigor and long-term investment perspective, Brett Icahn has played a key role in numerous high-profile investment decisions and activist campaigns. His career reflects a deep commitment to shareholder value and responsible corporate governance.

Icahn will serve as a member of the Board until the 2026 annual meeting of stockholders. Mr. Icahn’s appointment was not pursuant to any arrangements or understandings between him and the Company or any other person. There are no family relationships between Brett Icahn and any director, executive

officer or person nominated or chosen by the Company to become an executive officer of the Company within the meaning of Item 401(d) of Regulation S-K.

Since the beginning of the Company’s last fiscal year, the Company has not engaged in any transaction in which Icahn had a direct or indirect material interest within the meaning of Item 404(a) of Regulation S-K.He will enter into the Company’s standard form of Directors’ indemnification agreement

with the Company, pursuant to which the Company agrees to indemnify its directors to the fullest extent permitted by applicable law and to advance expenses in connection with proceedings as described in the indemnification agreement. Mr. Icahn is expected to receive compensation consistent with the Company’s standard arrangements for non-employee directors, which are described in the Company’s most recent proxy statement filed with the SEC.

On July 22, 2025, in connection with the appointment of Brett Icahn to the Board, the Company, Icahn Partners LP, Icahn Partners Master Fund LP, Icahn Onshore LP, Icahn Offshore LP, Icahn Capital LP, Beckton Corp., IPH GP LLC, Icahn Enterprises Holdings LP, Icahn Enterprises GP, Inc., and Carl C. Icahn

entered into a confidentiality agreement, a copy of which is filed as Exhibit 10.1 hereto and incorporated herein by reference.