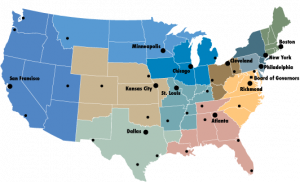

It’s not the kind of news the oil and gas industry wants to read, but the Federal Reserve Bank of Kansas City released the third quarter Energy Survey showing a decline in energy activity in the Tenth District that includes Oklahoma.

“District drilling and business activity posted a decline for the seventh consecutive quarter in Q3 and is not expected to rebound in coming months,” said Chad Wilkerson, senior vice president at the Federal Reserve Bank of Kansas City.

“However, employment continued to grow, and firms’ hiring plans are unchanged despite further contractions in revenues and profits.”

Tenth District energy activity declined further in the third quarter of 2024, as indicated by firms contacted between September 16th, 2024, and September 30th, 2024. The quarter-over-quarter drilling and business activity index was largely unchanged, compared to the previous quarter. Employment levels grew moderately, even as revenues and profits declined further.

Drilling activity also remained down from this time last year, with the year-over-year drilling and business activity index ticking down. Annual revenues decreased substantially and employment levels continued increasing from year-ago levels, but employee hours fell. Capital expenditures continued to decrease moderately, but access to credit stayed positive.

The survey also concluded that activity is expected to be slightly negative in the next six months, with the six-month drilling expectations index falling in the Q3.

Firms were asked what oil and natural gas prices were needed on average for drilling to be profitable across the fields in which they are active. The average oil price needed was $65 per barrel, while the average natural gas price needed was $3.43 per million Btu.

Firms were also asked what prices were needed for a substantial increase in drilling to occur across the fields in which they are active. The average oil price needed was $89 per barrel, and the average natural gas price needed was $4.24 per million Btu

Firms reported what they expected oil and natural gas prices to be in six months, one year, two years, and five years. The average expected WTI prices were $73, $77, $80, and $86 per barrel, respectively. The average expected Henry Hub natural gas prices were $2.73, $3.05, $3.33, and $3.68 per million Btu, respectively.

Firms were asked how their hiring and capital expenditures plans have changed since the beginning of the year. Most firms’ (87%) hiring plans are unchanged, while 6.5% now expect more hiring in 2024 than they did at the beginning of the year and another 6.5% expect less. Responses for capital expenditures were mixed, with 42% of firms reporting unchanged plans for capital expenditures, 35% expecting less, and 23% expecting more.

Click below for the Energy Survey

.