Devon Energy Corp. reported strong first quarter financial results including net earnings of $213 million or 32 cents a diluted share along with oil production of 268,000 barrels of oil a day that exceeded guidance by 5,000 barrels.

The Oklahoma company’s core earnings were $298 million or 45 cents a diluted share. Its operating cash flow was $592 million in the first quarter with EBITDAX reaching $959 million. The amount of cash flow was strong enough that it funded all capital requirements and generated $260 million of free cash flow after adjusting for cash restructuring charges.

“Devon is a premier energy company that possesses a powerful suite of assets and a disciplined strategy to maximize value for

our shareholders,” said Rick Muncrief, president and CEO. “With this advantaged platform, we delivered on exactly what we

promised to do in the first quarter by moderating capital investment, capturing cost synergies and returning significant value to shareholders through higher dividends and the aggressive reduction of debt.”

As a result of the strong showing, Devon’s Board of Directors increased the fixed-plus-variable dividend payout by 13% to 34 cents a share.

“Looking ahead to the remainder of the year, we are unwavering in our commitment to capital discipline and will remain focused

on the strategic objectives that underpin our cash-return business model,” Muncrief added. “Devon has no intention of allocating capital to growth projects until demand-side fundamentals recover and it becomes evident that OPEC+’s spare oil capacity is effectively absorbed by the world markets.”

During the first quarter, Devon also completed its merger with WPX Energy.

The company’s oil production was largely focused on the Delaware Basin which accounted for 62% of total production. Devon estimated the severe winter weather in February reduced production by about 8%. Its upstream capital spending was 5% below guidance and totaled $447 million in the first quarter.

Nearly 80% of the cap-ex was allocated to the Delaware Basin where Devon averaged 18 operated drilling rigs and six completion crews in the quarter. As a result of higher-margin production opportunities, oil and natural gas liquids volumes reached 74% of the company’s product mix in the quarter.

Devon said its exposure to higher value production expanded its field-level cash margin to $28.95 per BOE, an 88% increase year over year.

Delaware Basin: Oil production averaged 172,000 barrels per day, a 19 percent increase year-over-year on a pro forma

basis. The growth in oil production was driven by 52 wells that commenced first production in the quarter across the

company’s acreage position. The completed well costs associated with this development activity improved to a record low

of $534 per lateral foot in the quarter, representing a 43 percent reduction compared to 2018.

The top operating highlight from the first quarter was Devon’s Danger Noodle project in Lea County, New Mexico. This

development project, targeting multiple intervals in the upper Wolfcamp, achieved average 30-day production rates of

5,100 Boe per day per well (66 percent oil).

Another noteworthy event for Devon was the resumption of approvals for federal drilling permits. Since the Department

of Interior’s order to temporarily suspend permitting on federal lands lapsed in late March, the company has secured

more than 50 approvals for new drilling permits in Southeast New Mexico. In aggregate, Devon possesses approximately

500 federal drilling permits, representing an inventory of 4 years at the current drilling pace. Overall, only 35 percent of

Devon’s 400,000 net acres in the Delaware Basin resides on federal lands.

Anadarko Basin: Production averaged 68,000 Boe per day in the quarter. Devon’s operations were headlined by the

commencement of a two-rig drilling program funded by a $100 million drilling carry with Dow. With this drilling joint

venture, the company spud 8 wells in the liquids-rich core of the play during the quarter and plans to drill up to 30 wells

for the full-year 2021.

Williston Basin: Production averaged 61,000 Boe per day, with oil accounting for 72 percent of the product mix. Devon’s

operational focus in the quarter was optimizing base production and harvesting free cash flow from this high-margin oil

asset. To stabilize production, the company plans to bring online 15 to 20 new wells over the remainder of 2021.

In the Eagle Ford: Production averaged 30,000 Boe per day. Devon and its partner resumed capital activity in the quarter by

running a two-rig drilling program and a completion crew. With this level of activity, the partnership has reestablished

operational continuity and plans to bring online approximately 40 wells throughout the remainder of the year.

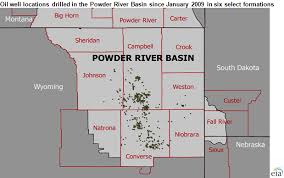

Powder River Basin: Production averaged 23,000 Boe per day, of which 74 percent was oil. Oil production increased by 6

percent versus the fourth quarter of 2020, resulting from 10 new wells that targeted the Parkman and Turner formations.

While capital activity will be limited for the remainder of 2021, Devon’s technical teams will focus on advancing their

understanding of the emerging Niobrara oil resource opportunity across the company’s 300,000 net acre position in the

oil fairway.

Devon exited the first quarter with $1.9 billion of cash and an undrawn credit facility of $3 billion. Year-to-date, the

company has made significant progress on its $1.5 billion debt reduction plan by redeeming $743 million of outstanding

debt. The next step in the company’s debt reduction plan is to fully retire its callable $500 million 2026 notes in June.

2021 OUTLOOK

Devon remains firmly on track to achieve its full-year 2021 capital objectives. The company is committed to its

maintenance capital program and has made no modifications to its full-year capital budget or production outlook.

Click here for Devon release