Teachers’ groups that unveiled a $905.6 million dollar plan to get pay raises have run into opposition from the Oklahoma Independent Petroleum Association.

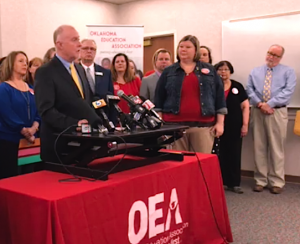

The plan unveiled last Friday by the Oklahoma Education Association, the Oklahoma Public Employees Association and the Oklahoma City American Federation of Teachers proposes a number of tax hikes. But what the OIPA is against is raising the gross production tax on oil and gas to 5 percent.

On Monday, the OIPA announced it was opposed to any legislative revenue plan increasing the gross production tax on new wells to 5 percent.

“The oil and natural gas industry is willing to support an increase in the gross production tax on new wells to ensure education and all other core government services are funded properly,” said OIPA Chairman Berry Mullennix, an independent producer from Tulsa. “However, an increase to 5 percent eliminates the economic advantage that has made Oklahoma one of the top places for oil and natural gas investment in the world and would deter future investment in our state.”

He said the board of directors of his organization had been behind Step Up Oklahoma’s plan to increase the tax on new wells to 4 percent. But that support was also contingent on other Oklahoma industries including wind power generation, tribal gaming and tobacco sharing the tax burden.

“We have seen tremendous growth in Oklahoma’s oil and natural gas industry following a historic decline in oil and natural gas prices,” Mullennix said. “Much of that growth can be attributed to tax policy that encourages companies to explore for and produce oil and natural gas in Oklahoma.”

Mullennix said growth in the oil and natural gas industry is directly correlated with growth in the state economy and, in turn, growth in state tax receipts.

“A tax rate for oil and natural gas companies that encourages development of Oklahoma’s oil and natural gas helps ensure growth continues and will provide state leaders with the additional dollars they need to fund state services, including education and teacher pay.”

The education groups are demanding legislative action this week or else teachers will walk out on April 2.

“This plan asks everyone to play their part and pay their part to give Oklahoma students a brighter future and all Oklahomans somme hope that better days lie ahead,” said OEA Executive Director David DuVall in unveiling the plan which would give teachers a $10,000 pay raise and $7,500 for state workers.

The new plan would increase taxes on cigarette by $1.50 a pack, raising another $211.7 million. The teachers also want a 10 percent levy on chewing and smokeless tobacco as well as small cigars, a move they say would raise $11.2 million.

The OEA plan also calls on the legislature to create something of a gross production tax on the wind industry. Supporters claim it will raise $20 million a year. The teachers and state workers want to allow Indian tribes to operate roulette and dice games in their casinos.

Their plan also calls for an increase in the motor fuel tax on gasoline and diesel fuel by 6 cents a gallon. The groups also want a statewide hotel and motel tax of $5 a room.