Williams announced its nearly $1 billion acquisition of the Haynesville gathering and processing assets of Trace Midstream on Monday.

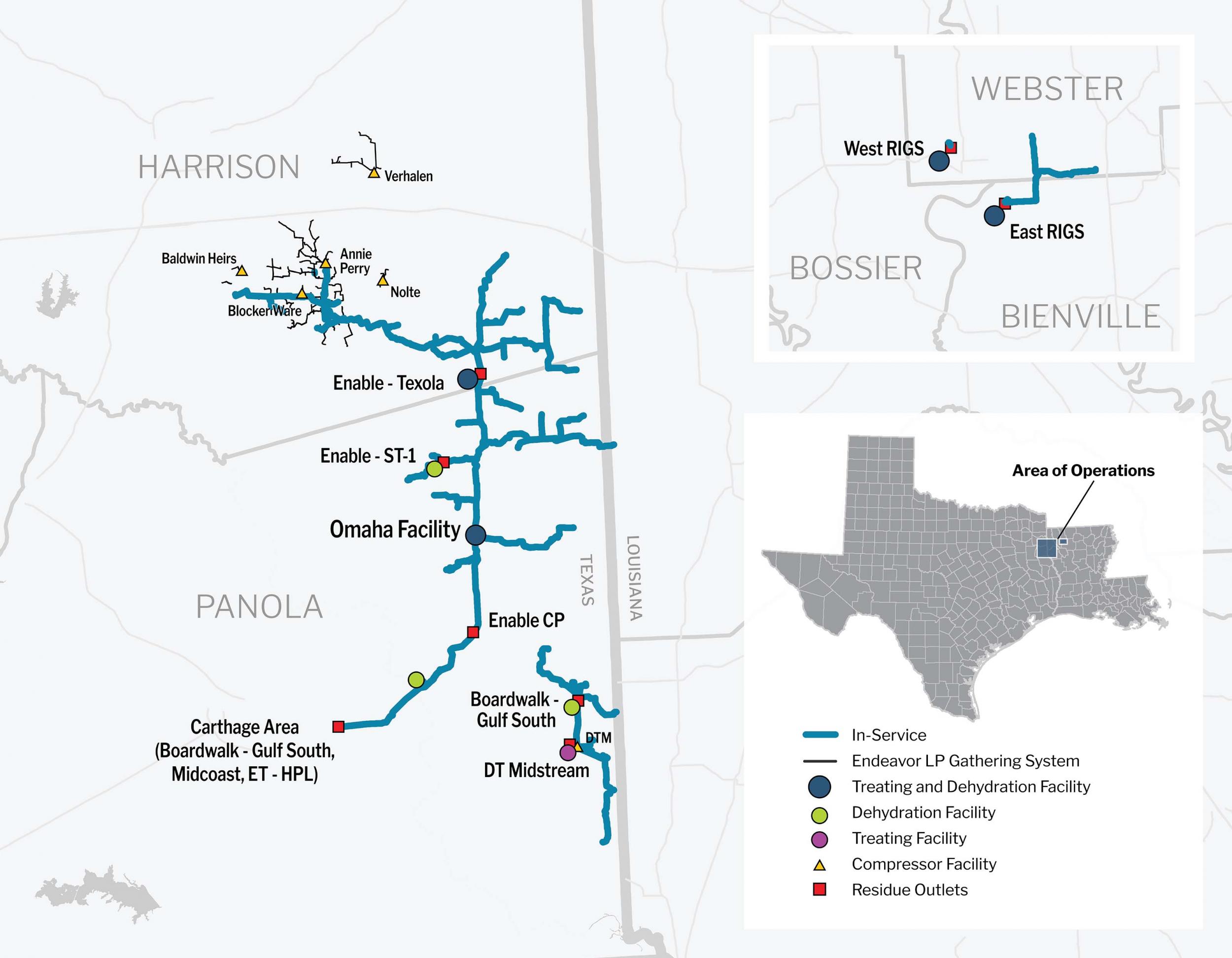

Trace is a portfolio company of Quantum Energy Partners and is being acquired in a transaction valued at $950 million. The acquisition will allow for an expansion of Williams’ existing footprint in the Haynesville, considered one of the largest growth basins in the U.S. It will increase the Williams gathering capacity in the basin from 1.8 Bcf/d to more than 4 Bcf/d according to the announcement.

Williams stated that the acquisition is expected to result in an investment at approximately 6 times 2023 EBITDA, with strong growth anticipated and minimal expansion capital required, thereby supporting Williams’ strong credit metrics.

As part of the transaction, Trace customer and Quantum affiliate Rockcliff Energy has agreed to a long-term capacity commitment in support of Williams’ Louisiana Energy Gateway (LEG) project. The LEG project is designed to gather responsibly sourced natural gas produced in the Haynesville and connect it to premium Transco markets, as well as growing industrial and LNG export demand along the Gulf Coast.

In further support of the LEG project, Williams signed a Memorandum of Understanding with Quantum to form a joint venture that will enable Quantum to become an equity investor and partner in the project. The partnership brings together Williams’ expertise as a leading developer and operator of clean energy infrastructure with Quantum’s abilities as a leading global provider of private capital to the responsibly sourced energy and energy transition & decarbonization sectors.

“Williams continues to increase scale and connectivity in the best and most efficient natural gas basins, and these transactions with Trace, Rockcliff and Quantum represent an important extension of our natural gas-focused strategy,” said Alan Armstrong, Williams president and chief executive officer.

“Importantly, this is going to be the flagship of our low carbon wellhead to water venture, proving up what an important role natural gas can play in reducing emissions, lowering costs and providing secure reliable energy here and around the world.”

“We have been rapidly expanding our Haynesville system to support growth from existing and new customers,” added Chad Zamarin, Williams senior vice president of Corporate Strategic Development. “By leveraging our scale, value chain integration and unique capabilities, including our Sequent Energy platform and New Energy Ventures clean energy solutions, we are facilitating the delivery of responsibly sourced gas to meet the climate goals and the energy needs of our customers and our country.”

The transaction is expected to close in the second quarter subject to regulatory approvals.

RBC Capital Markets served as lead financial advisor to Williams; Citi served as lead financial advisor to Trace. Williams was represented by Davis Polk & Wardwell LLP; Trace was represented by Vinson & Elkins LLP.