“I know this might have caught some of our investors and some of you guys by surprise.” Bill Berry, CEO Continental Resources

While leaders of Oklahoma’s Continental Resources were excited about their firm’s $3.25 billion deal to acquire Pioneer Natural Resources assets in the Permian Basin, investors had another thought.

After word was announced of the acquisition, Continental Resources slid to a six-week low in Wall Street trading.

During a conference call, Continental CEO Bill Berry said the firm had been exploring a potential Permian Basin deal for the past two decades.

“—never thought the time was right or the economics were right.”

Still…

“Like our first quarter Powder River Basin acquisition, this transaction is accretive on key financial metrics, and the acquired assets will complement our existing deep portfolio in the Bakken, Oklahoma and Powder River,” he said. One report by Bloomberg indicated it might not be the last purchase for the company and that Continental might spend up to $375 million on other acquisitions, yet this year.

With a continued commitment to strong free cash flow from operations, Berry said the Permian Basin deal will be an integral contributor to the company’s shareholder return plans.

“This is an outstanding asset with 92,000 acres, over 1,000 locations, 50,000 net royalty acres. The acquisition also comes with about 55,000 BOE per day from PDP and anticipated volumes from wells in progress. And finally, and possibly most importantly, this Permian transaction is projected to add up to 2% to our return on capital employed annually over the next five years.”

He said he was confident the acquisition will further enhance Continental’s free cash flow generation.

Why the Permian and why now?

“First and foremost, it’s all about the rocks,” explained Jack Stark, President and Chief Operating Officer.

“We estimate that these assets contain an inventory of over 650 gross wells targeting three primary reservoirs, including the third Bone Spring, the Wolfcamp A, Wolfcamp B, and we think there are over 1,000 locations when you consider other known producing reservoirs that underlie this acreage. On an economic basis, these assets complement our existing inventory very well delivering rates of return from 50% to well over 100% at $60 WTI and $3 NYMEX,” he told the conference call.

He pointed out that the 92,000 net leasehold acres being acquired are largely contiguous and Continental will operate 98% of it with an average working interest of about 93% per well. And Stark says the land has another special quality.

“The last point I’ll make on these assets is that they are in the early stage of development, which is exactly what we like. The initial phase of testing and reservoir delineation is complete and the properties are teed up for full field development. And as in all of our plays, we see significant opportunity to improve well performance and financial returns through optimized density and wellbore placement, operational efficiency gains and asset growth through exploration.”

Stark was also proud of the expansive efforts made by Continental in the past 18 months. He pointed to operations also in the Powder River Basin of Wyoming where Continental either owns or has under contract nearly 215,000 acres.

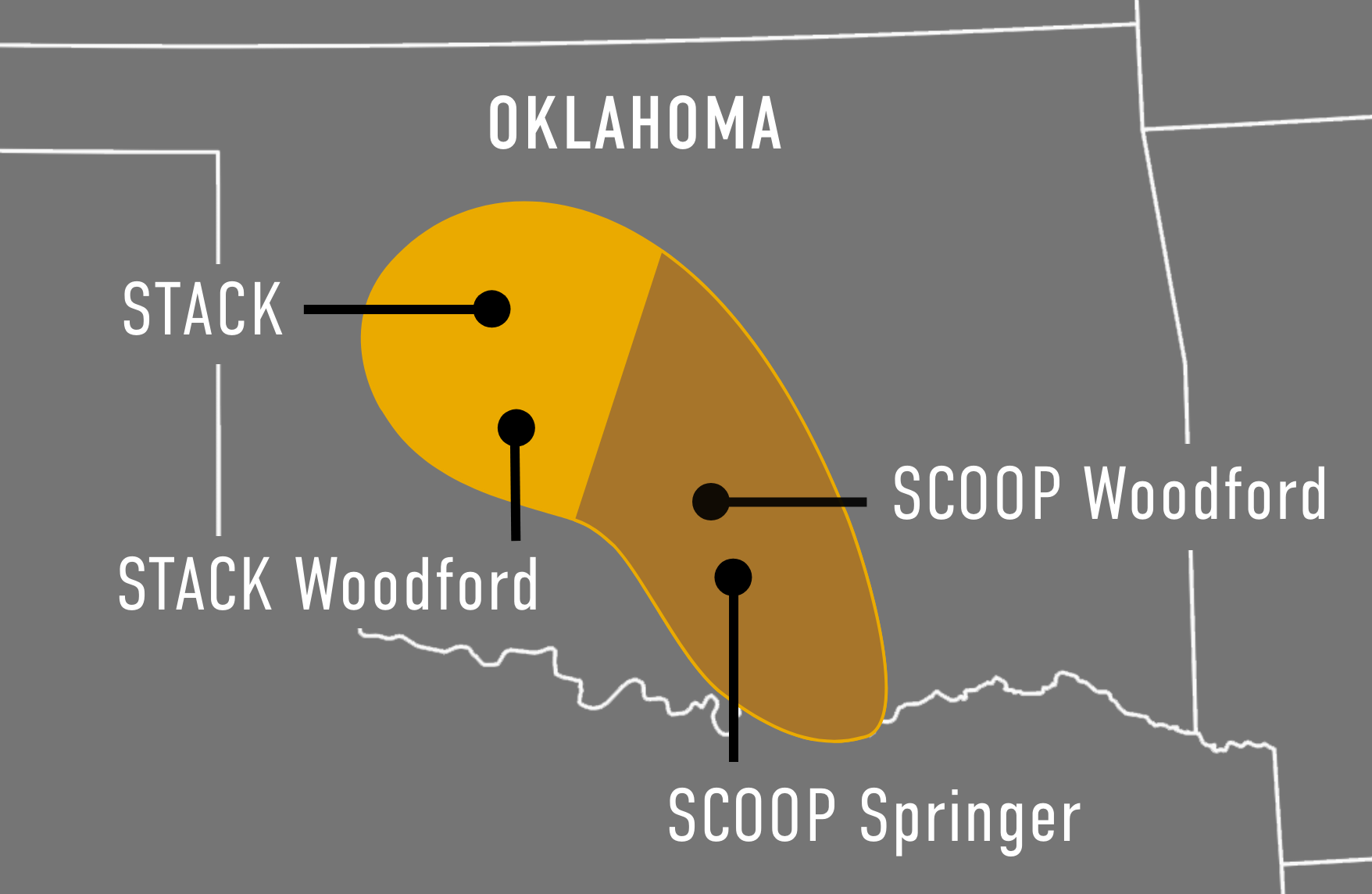

During the same time, the company also expanded through an additional 47,000 net acres in the heart of its springboard assets in Oklahoma.