Two Texas-based well completion companies, both with operations in Oklahoma are joining operations in a $407.5million deal.

ProFrac Holdings, LLC reached agreement in the all-cash deal to take over FTS International, Inc, another firm headquartered in Fort Worth.

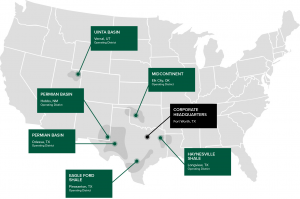

ProFrac, based near Fort Worth listed operations in Oklahoma but as the picture above illustrates, the facility is an empty warehouse near Yukon.

Under the terms of the agreement, which has been unanimously approved by FTSI’s Board of Director, FTSI stockholders will receive $26.52 per share of FTSI common stock in cash. This represents approximately a 14% premium over the Company’s 60-day volume-weighted average closing share price through October 21, 2021.

The transaction will create one of the largest completions focused service companies in the U.S. oil and gas industry. The combination of FTSI and ProFrac will bring together two strong industry players to deliver greater efficiencies and expanded equipment capabilities.

FTSI is based in Fort Worth and considered one of the largest well completion companies in the U.S. Its MidContinent district office is located in Elk City, Oklahoma.

“The Board and executive leadership team have carefully evaluated a range of strategic alternatives focused on maximizing value and determined that this cash offer from ProFrac, which provides immediate and certain value at an attractive price, is in the best interest of all stockholders,” said Eugene Davis, Chairman of the Board of FTSI.

“We have long respected FTSI and the people that have guided them through the past few years to the position of strength they are in today,” said Ladd Wilks, CEO of ProFrac. “Together, these two organizations, which share an employee-centric vision and approach to operating in a dynamic industry, will create the scale needed to deliver the reliable, efficient and technology-led service our customers need.”

The agreement includes a 45-day “go-shop” period expiring December 5, 2021. This allows the Board and its advisors to solicit alternative acquisition proposals from third parties. The Board will have the right to terminate the merger agreement with ProFrac to enter into a superior proposal, subject to the terms and conditions of the merger agreement.

FTSI’s Board has unanimously approved the agreement with ProFrac and recommends that FTSI stockholders vote in favor of the transaction at the Special Meeting of Stockholders to be called in connection with the transaction.

The transaction with ProFrac is expected to close in the first quarter of 2022, subject to customary closing conditions, including approval by FTSI stockholders and receipt of regulatory approvals.

Source: Business Wire