While Continental Resources reported a strong second quarter, strong enough to result in $634 million in free cash flow, company leadership is also taking a serious approach to the role oil and gas has in the world of politics and the impact on the environment.

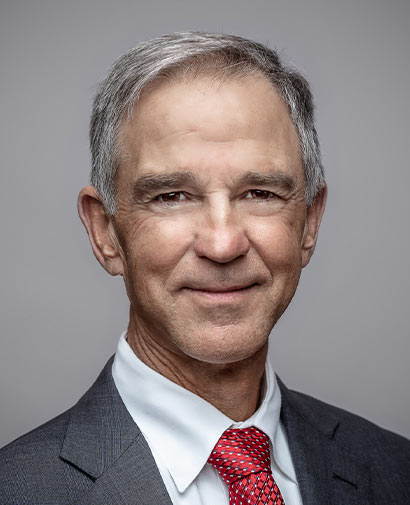

A day after announcing second quarter financial results which were so strong the company is restarting a $1 billion share repurchase program, Continental CEO Bill Berry spoke of the company’s continued focus on ESG.

“While there’s a lot of focus on the environmental audit from all of us, we believe that societal is underrepresented in a global dialogue, a lack of energy across – access across the world equates to poverty, which all members of society should seek to improve,” he told an earnings call this week.

Berry made it clear to shareholders that Continental is focused on continuously improving its ESG efforts. But he also suggested the world cannot survive without oil and gas and the U.S. environmental and energy efforts must include an “all of the above” approach.

“We believe it is essential all countries and all economic participants do their part to improve the ESG in the same way, in order to better our world. Crude oil and natural gas will continue to play a vital role in the global energy mix. And the entire world needs multiple forms of energy to move people from poverty to appropriate levels of societal quality of life,” said Berry.

Otherwise, the company leader was excited about its “robust and company record-breaking free cash flow” and “exceptional performance.”

The company also remains “unhedged” on crude oil as he put it.

“While we remain bullish on commodity prices given the volatility of price cycles and potential impact of government reaction to COVID variants, we continue to believe it is inappropriate for the industry to overproduce into a potentially oversupplied market, particularly with respect to crude oil,” said Berry.

Continental has about 50% of its volume hedged through the end of 2021 but none beyond the first quarter of 2022 and no hedges at all in the year.

Click here for Seeking Alpha