Dallas-based Tall Oak Midstream expanded its Oklahoma holdings with the recent acquisition of Redcliff Midstream, a provider of gas gathering, treating and processing services to producers in Oklahoma’s STACK play.

Neither company disclosed the financial amounts involved. Redcliff Midstream, founded in 2017 as a wholly owned subsidiary of Canyon Midstream Partners II, LLC had more than 200 miles of gathering pipeline. It also had a network of five field compression stations across Woodward, Dewey, Blaine and Canadian Counties and a 240 MMcf/day cryogenic gas processing plant in Woodward County.

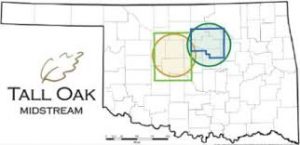

The acquisition, according to the announcement will complement Tall Oak II’s existing asset base which includes more than 750 miles of low-and high-pressure gathering lines across seven Oklahoma counties. It will also expand its infrastructure footprint in the Northern STACK Extension region.

In January 2021, Tall Oak was acquired by Tailwater Capital, a private equity firm based in Dallas. The transaction closed in February 2021.

“Redcliff Midstream’s complementary network of high-quality assets and its diverse customer base are a perfect fit for Tall Oak as we continue to grow our footprint and service offerings in the region,” said Max Myers, Chief Financial Officer of Tall Oak. maintaining best-in-class service for our customers.”

“Redcliff brings an attractive asset base with newly-built pipelines and high-quality compression and processing facilities that augment Tall Oak’s existing capabilities and grow the existing platform,” said Jason Downie, Co-Founder and Managing Partner at Tailwater Capital.

“The Northern STACK Extension encompasses a robust inventory of economic undeveloped drilling locations and underutilized midstream infrastructure that Tall Oak is actively evaluating as it searches for accretive bolt-on opportunities to expand its regional footprint. Ryan, Carlos, Max, Lindel and the rest of the exceptional Tall Oak management team are uniquely suited to execute on this consolidation strategy given their deep knowledge of the basin and extensive relationships with nearby customers and competitors alike.”

Source: press release