While Continental Resources reported a total 2020 net loss of nearly $597 million or $1.65 per diluted share, the Oklahoma City energy indicated it plans an expansion of its Wyoming drilling operations in March. It is finalizing a $215 million acquisition in Wyoming.

The full-year 2020 adjusted net loss was $424 million or $1.17 per diluted share and net cash provided by Continental’s operating activities was $1.42 billion.

Continental’s fourth quarter net loss was $92.5 million or 26 cents a diluted share. Typically excluded items in the quarter represented $10.6 million or 3 cents a diluted share. The company’s adjusted net loss for the quarter was $81.9 million or 23 cents a diluted share.

Net cash provided by the fourth quarter operating activities came to $487.5 million.

Continental averaged more than 300,000 Boepd for its full-year 2020 total production and 160,000 oil production. Natural gas production for the year averaged 837.5 MMcfpd while in the fourth quarter it totaled an average of 976.0 MMcfpd.

Fourth quarter oil production averaged 176,639 Bopd.

Continental said its 2020 completed well cost targets in the Bakken and Oklahoma with go forward well costs of $690 per lateral foot in the Bakken and $1,070 per lateral foot in Oklahoma.

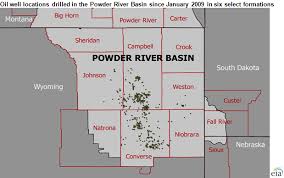

As for the Powder River Basin in Wyoming, Continental has executed documents to acquire nearly 130,000 net acres and approximately 9,000 Boepd of production in a $215 million deal.

It said the acquisition included 96 approved federal drilling permits which should be closed in March. The company will start developing the Shannon, Frontier and Niobrara reservoirs with two rigs in the second quarter 2021.

“These Powder River Basin assets provide Continental another oil-weighted platform, adding over 400 MMBoe of net unrisked resource potential to our portfolio,” said Jack Stark, President and Chief Operating Officer. “We especially like the fact that the basin is in the very early stages of development with solid economics even before applying our low cost efficient operations.”

Click here to read the Continental earnings report release.