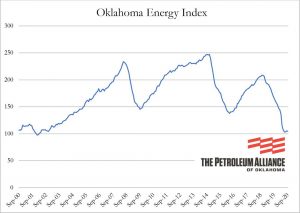

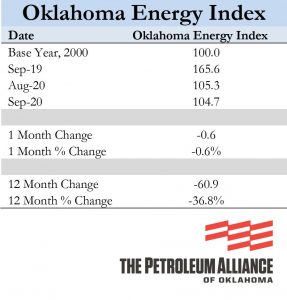

By all indications from the Oklahoma Energy Index, the state’s energy recovery from the effects of the COVID-19 pandemic might take longer than expected—perhaps not until late next year or even until 2022.

The Index was released on Friday showing a nearly 37% decline compared to a year ago and a 0.6% drop just in the past month.

The announcement stated the obvious…the state’s precipitous decline in drilling activity, something that also brought with it a dramatic loss in oilfield jobs is still dragging down the Index.

“The barometer of Oklahoma’s oil and natural gas industry is the drilling rig. The more rigs dotting the Oklahoma landscape, the more vibrant the state’s defining industry and overall economy,” said the announcement.

But those with the Index weren’t optimistic about any quick turnaround in the industry in Oklahoma.

“Any significant increase in new drilling activity will likely be deferred until later in 2021 when economic conditions improve and demand for energy rebounds,” said Dr. Russel Evans, executive director of the Steven C. Agee Economic Research and Policy Institute. “The Permian Basin is the expected first mover in this return to drilling, leaving Oklahoma open to the possibility that a significant rebound in field activity may not materialize here until late 2021 or 2022.”

Evans noted that Oklahoma stands alone in the decline in drilling activity when compared to other similar energy producing states. Throughout 2019, Oklahoma’s peer states saw minimal declines in state rig counts, with New Mexico and North Dakota losing just five drilling rigs combined.

In Oklahoma, however, during that same time frame, rig activity fell 61%, dropping from 132 to 52 rigs. For the first 10 months of 2020, when decreased demand for crude oil driven by the COVID-19 pandemic stymied energy markets and sent oil prices to historic lows, demand for drilling activity fell as well, and Oklahoma rig activity fell another 75% from 52 to 13 rigs.

The 2020 decrease in drilling activity is on par with other energy producing states, but the double whammy decrease seen in 2019 and 2020 in Oklahoma foretells a longer road to recovery than the nation’s other leading oil-producing states.

“It is precisely this differential response entering this cycle that points to a differential response exiting the cycle, with Oklahoma lagging rather than leading the recovery,” Evans said.

Petroleum Alliance President Brook A. Simmons said the oil and natural gas industry’s role as an employment driver for the state is dependent on continued drilling activity. With the limited number of drilling rigs running in the state today, Simmons said the industry’s slower recovery will reverberate throughout the economy and policymakers need to realize this.

Source: the Petroleum Alliance of Oklahoma