|

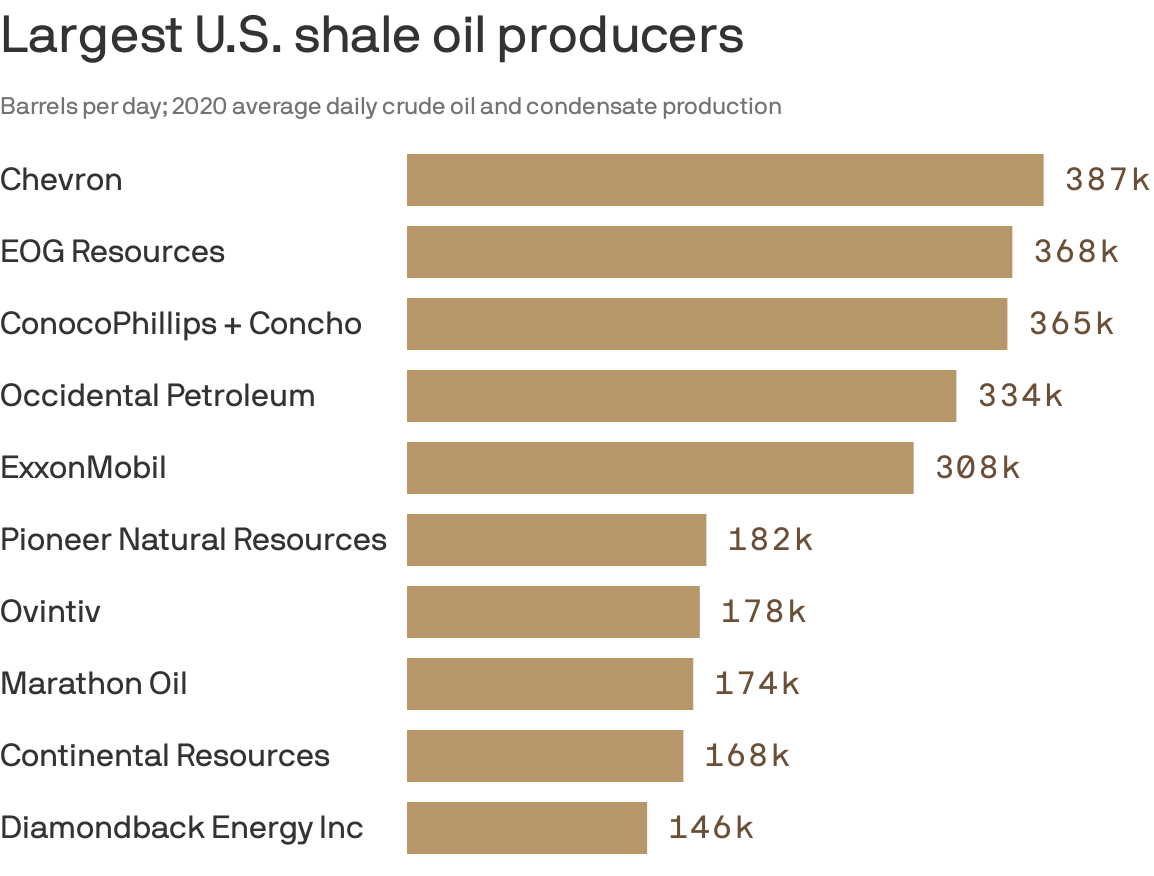

The acquisitions and mergers of the past few months have resulted in a shift of the largest shale players in the country. Some are based in Oklahoma while many others have sizeable operations in the state.

The latest acquisition said to be in the making is Pioneer Natural Resources which the Wall Street Journal reported is in talks to buy Parsley Energy.

It is only the latest potential takeover to be reported, something that was discussed months ago when the coronavirus pandemic hit the world and energy analysts suggested at the time that some smaller energy firms would be ripe for a takeover.

The Pioneer-Parsley report came literally on the heels of the $9.7 billion all-stock deal by ConocoPhillips to acquire Concho Resources.

But there was also the late-September announcement that Devon Energy had merged with WPX Energy. Previously Chevon bought out the big independent Noble Energy. As a result of all of the acquisitions and mergers, it resulted in a change of the nation’s top ten shale producers.

But the figures in the chart at the top of this story don’t reflect Chevron’s just-completed acquisition of Noble Energy, nor Devon Energy’s proposed merger with WPX Energy, which would put them on the list.

Robert Clarke, a top WoodMac analyst, the deal makes sense reported Axios.

He notes that Concho’s history gives them a lot of “incumbent” knowledge about the prolific Permian Basin, while Conoco is a “proven leader” in shale tech overall.

“This can be seen in how its Bakken and Eagle Ford projects have progressed down the cost curve as well as how successfully it manages later-life shale declines,” he adds.

Source: Axios