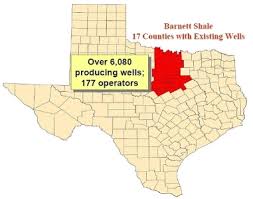

With the release of its second quarter earnings report on Tuesday, Oklahoma City-based Devon Energy also announced an accelerated closing of its $770 million sale of its Barnett Shale holdings in north Texas.

The original announcement in December 2019 indicated the closing with Banpu Kalnin Ventures would be Dec. 31, 2020. But this week, Devon said the new closing would be Oct. 1, 2020 and as part of the accelerated closing, the company’s board of directors declared a $100 million special dividend which amounted to 26 cents a share of Devon common stock.

The special dividend is payable on Oct. 1, 2020, to shareholders of record at the close of business on Aug. 14, 2020. This special dividend is in addition to the regular quarterly cash dividend of $0.11 per share.

The company also anticipates achieving $300 million of sustainable cash cost savings by the end of 2020 as a result of the accelerated closing. It intends to use some of the cash on hand to repurchase up to $1.5 billion of additional debt. The debt-reduction program is expected to result in a go-forward interest savings of approximately $75 million on an annual run-rate basis. The company plans to evaluate various transaction structures to achieve this debt reduction target, including open-market purchases and tender offers.

The Barnett Shale sale agreement also provides Devon the opportunity for contingent cash payments of up to $260 million based upon future commodity prices, with upside participation beginning at either a $2.75 Henry Hub natural gas price or a $50 West Texas Intermediate oil price. The contingent payment period commences on Jan. 1, 2021, and has a term of four years. The contingent payments are earned and paid on an annual basis.

“With the visibility we have on the early closing of the Barnett transaction, I am excited to announce that we are returning a portion of the proceeds to our shareholders in the form of a $100 million special dividend,” said Dave Hager, president and CEO. “The decision to issue a special dividend is consistent with our disciplined strategy and demonstrates our firm commitment to return increasing amounts of cash directly to our shareholders.”

A key contributing factor to the cost-reduction plan is Devon’s intent to repurchase up to $1.5 billion of its outstanding debt.

“As we navigate through the challenges presented by COVID-19, Devon continues to transform how it operates. The next phase of our strategic plan is to take meaningful and decisive steps to sustainably improve our cost structure and reduce debt,” said Jeff Ritenour, executive vice president and chief financial officer. “The aggressive reduction of cash costs across our organization is expected to drive down per-unit expenses by an incremental 10 percent versus our second-quarter 2020 results.”

Click here to view entire Devon release.

Source: Devon Energy