Devon Energy isn’t finished with its cost-cutting moves and announced Wednesday, it intends to suspend drilling and exploration operations in three targeted oil plays including the Anadarko Basin in Oklahoma.

President and CEO Dave Hager said it is part of the company’s 2020 spending plan to limit spending to $1 billion in 2020 and a decline of 45% compared to the original budget set before the coronavirus and the oil price war crisis hit the country.

“— we have elected to continue to invest and preserve operational continuity in the Delaware Basin to generate the necessary cash flow to effectively operate our business while suspending all capital operate our business while suspending all capital activity in the Anadarko, Eagle Ford and Powder River plays until market conditions improve,” he said during a conference call held to discuss the company’s financial results which included a recorded loss of $1.8 billion in the first quarter.

Hager described them as “weak markets” and to combat what he called a “challenged commodity price backdrop,” Devon plans to reduce its current well completion activity by nearly 65% to the first quarter. He said the decision to limit the wells being brought online will give Devon a Drilled but Uncompleted backlog of nearly 100 wells at the end of the year.

“And for those wells that we have brought online recently, we restricted the full raise to ensure that we do not deliver flush production into these tough markets.”

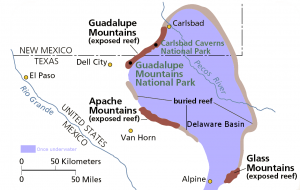

The Delaware Basin is in far west Texas and part of the Permian. The Anadarko covers much of western Oklahoma while the Eagle Ford is in South Texas and the Powder River basin is in Wyoming.

“While we believe this is a prudent program for the current environment, given the uncertainty regarding the depth and duration of this pricing downturn, I do want to highlight that we have tremendous flexibility with our go-forward capital plans,” continued Hager.

The Devon leader told analysts and shareholders the company intends to improve its cash flow by targeting nearly $250 million in cash cost reduction by the end of the year.

“This cost reduction plan includes a range of actions to lower field level operating expenses and to continue to optimize the organization’s overhead. This includes an expected 40% reduction in cash compensation for our executive management team year-over-year,” said Hager who added the company is not done finding ways to save money. “There are several initiatives underway that will further trim our cost structure and I expect to provide updates on these initiatives in future calls.”

“While no one could have accurately predicted timing or wide range the impact of this pandemic to the global economy or our industry, I am confident that Devon has entered this period of volatility with an extremely firm foundation.”

The first key message I want to convey today is that we have the financial strength to withstand an extended downturn. As you can see on slide three of our earnings presentation, Devon had $4.7 billion of liquidity, consisting of $1.7 billion of cash and $3 billion of undrawn capacity on our credit facility at the end of the quarter.

Source: Devon conference call