Enverus, an oil and gas data analytics company says several oil and gas firms active in the Permian Basin could be ripe for acquisition in 2020, including a handful of Oklahoma-based firms.

The Austin, Texas based company released its summary of 2019 deal activity and outlook for 2020, suggesting the trend of buying small and midcap energy companies with valuable Permian acreage will continue in the new year.

Who could be a likely target? Several companies “meet the criteria” for an acquisition target including WPX Energy and Laredo Petroleum. Enverus did not offer details why the two firms could be acquisition targets but said Centennial Resource Development, Matador Resources, QEP Resources, SM Ejergy and privately held Halcon Resources could also be targets.

Here’s how Enverus assessed other 2019 deals:

Backing out the Occidental/Anadarko deal, 2019 saw $39 billion in deals or just one-half of the average $78 billion for annual U.S. oil & gas M&A during the last 10 years, which also saw the rise of U.S. unconventional assets. M&A played a key role along the way, with $567 billion spent on shale assets or 73% of the total during that time. E&Ps poured even more into funding drilling, including major ramp ups of oil output in the Bakken, Eagle Ford, and Permian Basin. However, the available capital that made shale possible largely dried up in 2019.

“Investors who funded the shale revolution over the last decade have become vocal in advocating for payouts and cut back on providing new capital. That flowed through to limited M&A and a negative reaction to deals for much of the year,” said Enverus Senior M&A Analyst, Andrew Dittmar. “However, we saw an uptick in December in the pace of deals and more positive investor reactions to acquisitions. That should bode well for M&A in 2020.”

Occidental’s acquisition of Anadarko highlighted 2019’s consolidation in the shale patch. The deal is in the ballpark of Exxon’s 2009 acquisition of XTO as the most spent on shale in a deal. Occidental saw 75% of Anadarko’s value in shale, including the Permian Basin.

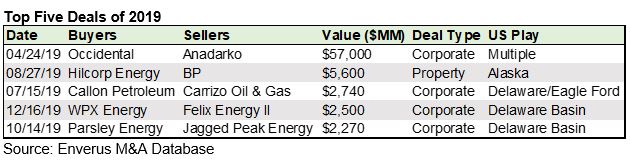

Most of 2019’s other marquee deals also focused on the Permian. After Occidental/Anadarko, 2019’s largest corporate deals were Callon’s $2.7 billion merger with Carrizo, WPX’s $2.5 billion buy of private Felix Energy II, and Parsley’s $2.3 billion acquisition of Jagged Peak.

WPX’s $2.5 billion acquisition of EnCap-funded Felix in December 2019 was notable for several reasons. Besides being the largest deal of Q4 and fourth largest deal of 2019, the acquisition of a premier private equity position in the Permian shows there are still exits available for the “built to sell” model of private equity portfolio companies. WPX also outperformed the broader markets on news of the deal, compared to most buyers being sold off on news of M&A.