NGL Energy Partners LP of Tulsa announced the closing of its previously announced acquisition of all of the assets of Mesquite Disposals Unlimited, LLC for a total purchase price of $892.5 million on a cash-free, debt-free basis, a portion of which will be funded in deferred payments.

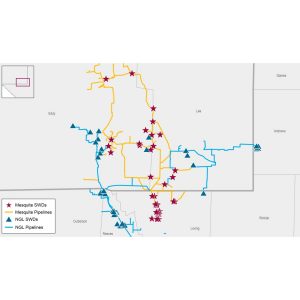

“The closing of our Mesquite transaction creates the largest water disposal system in the Delaware Basin with permitted capacity exceeding two million barrels per day, but more importantly, the redundancy required by our customers,” stated Mike Krimbill , NGL’s CEO. “The combined system provides multiple transportation, disposal and recycling options throughout Lea and Eddy Counties that allows NGL to deliver on its commitments. The Mesquite family will work alongside NGL, operating these assets while expanding the business with additional facilities and contracts.”

The acquisition purchase price was funded with the following sources of capital:

- $400 million aggregate gross proceeds from privately placed equity securities sold for cash to investment funds managed by EIG Global Energy Partners (“EIG”) and FS Energy and Power Fund (“FSEP”);

- $100 million of additional NGL preferred units based on market value of an existing class, issued to certain beneficial owners of Mesquite as part of the acquisition consideration;

- $250 million gross proceeds from a new 5-year secured term loan with TD Securities (USA) LLC , as lead arranger and bookrunner, and The Toronto-Dominion Bank , New York Branch, as initial lender; and

- Any remaining funding requirements are expected to be paid from borrowings under the Partnership’s existing revolving credit facility.

“We are also excited to announce the investment in NGL by EIG,” stated Mr. Krimbill. “In conjunction with our partnership with EIG, we welcome Brian Boland to our Board of Directors. We appreciate EIG’s support in the diligence and financing of this highly strategic acquisition and look forward to working with Brian and the EIG team on new opportunities in the near future.”

Brian Boland , Managing Director and Co-head of Midstream at EIG added, “We are thrilled to be making this investment in NGL and its diversified, high-quality asset base that includes what we believe to be the preeminent, multi-basin water solutions platform in the United States . We expect the acquisition of the Mesquite assets, together with NGL’s existing footprint in the Northern Delaware basin, to provide NGL with unmatched scale and capabilities that will facilitate best-in-class execution for its customers. NGL’s system is strategically located in the core of the Delaware basin and is well-positioned to capture significant volume growth as produced water levels continue to rise alongside rapidly growing oil production. We look forward to working with the NGL team towards this next phase of growth for the Partnership and its stakeholders.”

“Thank you to EIG and to the team at TD Securities for their support in completing the financing strategy for the closing of the Mesquite transaction,” stated Trey Karlovich , NGL’s CFO. “Pro forma for Mesquite’s first year contribution, we were able to complete this financing while maintaining our 3.25x compliance leverage target and managing our cost of capital, while maintaining flexibility around our capital structure and debt maturities.”