Refinery operator Holly Energy Partners, L.P. reported first quarter 2019 net income of $51.2 million or 49 cents per basic and diluted limited partner unit.

It was an increase from the $46.2 million or 44 cents per unit reported in the first quarter of 2018.

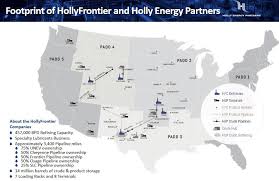

Distributable cash flow from its operations in Tulsa, Oklahoma, El Dorado, Kansas and New Mexico and Utah totaled $70.6 million for the quarter, an increase of $1.5 million or 2.2 percent compared to the first quarter of last year.

The increase in net income attributable to HEP was mainly due to higher crude oil pipeline volumes around the Permian Basin, higher revenues on our refinery processing units, and contractual tariff escalators. These gains were partially offset by higher interest expense.

Revenues for the quarter were $134.5 million, an increase of $5.6 million compared to the first quarter of 2018.

Revenues from the company’s refined product pipelines were $36.3 million, an increase of $1.5 million, on shipments averaging 211.9 thousand barrels per day (“mbpd”) compared to 217.0 mbpd for the first quarter of 2018.

The volume decrease was mainly due to pipelines servicing HollyFrontier Corporation’s (“HFC” or “HollyFrontier”) Woods Cross refinery, which had lower throughput due to operational issues at the refinery during the quarter partially offset by higher volumes from Delek. The increase in revenues was mainly due to higher Delek volumes and contractual tariff escalators.

Revenues from Holly’s crude pipelines were $31.5 million, an increase of $2.7 million, on shipments averaging 527.3 mbpd compared to 486.4 mbpd for the first quarter of 2018. The increases were mainly attributable to increased volumes on its crude pipeline systems in New Mexico and Texas and on our crude pipeline systems in Wyoming and Utah.

Revenues from terminal, tankage and loading rack fees were $37.6 million, a decrease of $0.6 million compared to the first quarter of 2018. Refined products and crude oil terminalled in the facilities averaged 442.7 mbpd compared to 452.8 mbpd for the first quarter of 2018. The volume decrease and associated revenue decrease were mainly due to the planned turnaround at HFC’s Tulsa refinery and operational issues at HFC’s El Dorado refinery in the first quarter of 2019.

Click here to read entire report.