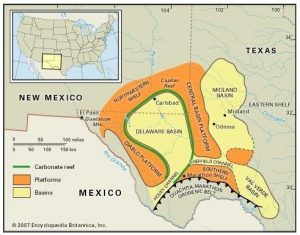

Tulsa’s Williams company has reached out to Brazos Midstream to form a joint venture for storage and movement of oil and gas out of the Delaware Basin in west Texas. It’s an expansion of energy operations for Williams, an Oklahoma company that already has 33,000 miles of pipeline operations across the U.S.

Under the agreement, Williams will contribute its existing Delaware Basin assets to the partnership in exchange for a 15 percent minority position in the joint venture.

The contribution of the Williams assets will expand the footprint of the current Brazos system and the two contend it will provide existing and prospective customers “with an enhanced suite of services.”

With 85 percent ownership of the joint venture, Brazos Midstream, based in Fort Worth will operate 725 miles of gas gathering pipelines and 75,000 barrels of oil storage in Reeves, Loving, Ward, Winkler, Pecoas and Culberson counties in Texas.

The company is currently constructing a previously announced 200 MMcf/d Comanche III natural gas processing plant to be fully operational by the first quarter of 2019. The plant will bring the partnership’s total operated processing capacity in the Delaware to 460 MMcf/d.

The announcement indicated the venture will be supported by more than 500,000 acres of long-term dedications from leading major and independent oil and gas producers.

As part of the transaction, Williams and Brazos have also entered into an agreement to jointly develop natural gas residue solutions to further benefit Delaware Basin producers.

“This joint venture increases our scale in the Delaware Basin, including a much larger footprint, new processing capabilities, and greater exposure to an impressive customer base,” said Williams Senior Vice President for Corporate Strategic Development, Chad Zamarin. “We are pleased to partner with Brazos Midstream on this joint venture. Their high-quality gathering pipelines and processing assets, combined with their industry-leading capabilities in Reeves, Ward, and Pecos counties are an excellent match for the gathering systems and additional capabilities that Williams is contributing as part of this transaction.”

Williams President and Chief Executive Officer, Alan Armstrong added, “This transaction is another example of high-grading our portfolio by leveraging an existing asset into a larger integrated system with better growth, in a manner that improves our credit metrics over time.”

RBC Capital Markets acted as the lead financial adviser to Williams for this transaction.

Today’s announcement does not affect Williams’ current financial guidance.