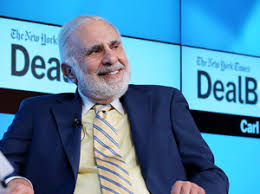

Activist investor Carl Icahn waited only a few days to respond to the latest round of the proxy fight with SandRidge Energy Inc. in Oklahoma City and blasted the company for its operations.

In a filing made with the Securities Exchange Commission, Icahn responded point by point to the claims of SandRidge Energy which wants shareholders to re-elect the board.

Icahn maintains shares of the company have fallen 23% from before the announcement of the controversial Bonanza Creek purchase last year.

“The board has expressed no clear vision or strategy while production has fallen 19% year-on-year,” stated Icahn in the filing.

He also alleged the company has been unable to execute on existing assets including the Mississippi Lime and the Northwest STACK.

While SandRidge stated that shareholder protection is its highest priority, Icahn argued otherwise.

“The board adopted an unorthodox poison pill that would make a totalitarian dictator blush in a brazen attempt to muzzle shareholders while allowing management and the board to continue to campaign for the reckless Bonanza Creek transaction,” he stated.

When SandRidge boasted of the experience of three of its top leaders, Icahn disagreed.

“Yet these same three geniuses now preside over a company with an oil hedging program that can only be described as disastrous.” Icahn took the three to task for hedging 3.8 million barrels of oil at an average price of $55.75 per barrel in 2018 and hedging another 1.8 million barrels of production in 2019.

Icahn went on to state that he and his companies have yet to decide whether they will make an offer to buy SandRidge. And he continued his assault on the company board of directors.

“It is beyond ludicrous that the incumbent directors are now expecting stockholders to throw a parade in their honor for finally taking a few small, half-hearted steps to discharge their fiduciary duties.”

“After our experience with these directors and judging how they have disregarded the interests of stockholders, we do not trust them and want absolutely nothing to do with them.”